When it comes to managing investments, the rise of online platforms has revolutionized how we trade stocks, commodities, and even currencies. For both beginners and experienced investors, a reliable stock trading platform or a CFD trading platform can make a world of difference. But what are the advantages of these platforms, and how can they help you achieve your financial goals? Let’s dive into the details.

Table of Contents

What Are the Advantages of Using a Stock Trading Platform?

Stock trading platforms offer several benefits that cater to modern investors. Whether you’re looking to invest in shares of your favorite companies or explore diversified portfolios, these tools provide unmatched convenience and control.

1. Accessibility and Convenience

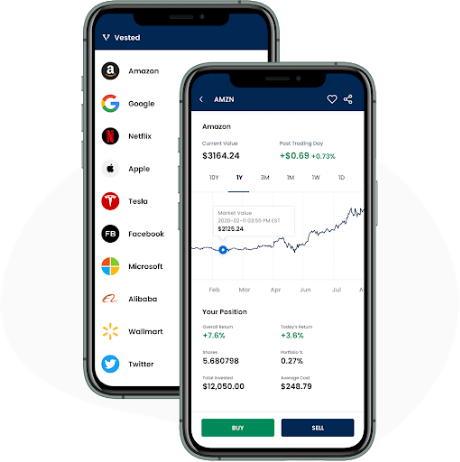

One of the biggest advantages of stock trading platforms is their accessibility. You can manage your investments from anywhere, whether you’re sitting at home or traveling abroad. Gone are the days of calling your broker to place trades. Instead, platforms enable instant transactions with just a few clicks.

Most platforms also come with mobile applications, allowing you to monitor and trade stocks from your smartphone. This 24/7 accessibility ensures that you can capitalize on market movements as they happen.

2. Cost-Effective Trading

Traditional brokerage fees often deter people from investing, but stock trading platforms have significantly reduced these costs. Many platforms offer zero or low-commission trading, which means you can retain more of your profits. For those who trade frequently, these savings add up quickly.

3. A Wealth of Resources and Tools

Modern stock trading platforms are packed with features that help you make informed decisions. From real-time data and charting tools to educational resources, these platforms provide everything you need to understand market trends. Some even offer demo accounts where you can practice trading without risking real money.

4. Diversification Made Easy

Investing in a diverse portfolio is crucial for managing risk, and stock trading platforms make this easier than ever. With a wide range of stocks, ETFs, and mutual funds available, you can build a portfolio tailored to your financial goals.

What Is a CFD Trading Platform, and Why Is It Worth Considering?

A CFD trading platform (Contract for Difference) is another powerful tool for investors. CFDs allow traders to speculate on price movements without owning the underlying asset. But why should you consider CFD trading platforms?

1. Leverage: Amplify Your Investments

CFD trading platforms offer leverage, which means you can control a larger position with a smaller amount of capital. While this increases your potential gains, it’s important to remember that it also magnifies losses.

2. Trade Across Multiple Markets

CFDs enable access to a variety of markets, including stocks, indices, commodities, and forex. This flexibility allows you to take advantage of market opportunities across different sectors, all from a single platform.

3. Ability to Short-Sell

Unlike traditional stock trading, CFDs allow you to profit from falling markets. By short-selling, you can take advantage of declining prices, making CFD platforms ideal for volatile market conditions.

4. Risk Management Features

CFD platforms often include advanced risk management tools, such as stop-loss orders and negative balance protection. These features help you minimize potential losses and maintain control over your trading strategy.

How to Choose the Best Stock Trading Platform for Your Needs

Selecting the right Best Stock Trading Platform can be overwhelming, given the many options available. Here’s how to make an informed choice:

1. Assess Platform Features

Look for platforms that offer the tools you need. Whether it’s real-time data, customizable charts, or educational content, ensure the platform aligns with your trading style.

2. Evaluate Costs and Fees

Low fees are a major advantage, but be wary of hidden costs such as withdrawal fees or inactivity charges. Compare platforms to find the most cost-effective option.

3. Check Security Measures

A good platform prioritizes the security of your funds and personal data. Look for features like two-factor authentication and encryption.

4. Consider Customer Support

Reliable customer support is crucial, especially if you’re new to trading. Ensure the platform offers multiple support channels, such as live chat, email, or phone assistance.

Are CFD Trading Platforms a Good Fit for Beginners?

While CFD trading platform are popular, they may not be suitable for everyone. Here’s why:

1. High Risk Due to Leverage

CFDs are high-risk instruments, making them better suited for experienced traders. Beginners may find the concept of leverage daunting and should proceed with caution.

2. Steeper Learning Curve

Understanding how CFDs work takes time. However, many platforms offer demo accounts and educational materials to help beginners get started.

3. Potential for Quick Gains and Losses

CFD trading is fast-paced, which can be exciting but also overwhelming for new traders. Starting with small trades and learning the basics can help mitigate risks.

Advantages of Combining Stock Trading and CFD Platforms

For traders looking to diversify their strategies, combining a stock trading platform with a CFD trading platform can be advantageous. Here’s why:

1. Flexibility Across Markets

By using both types of platforms, you can invest in long-term assets through stocks while capitalizing on short-term market movements via CFDs.

2. Comprehensive Risk Management

Having access to both platforms allows you to hedge your investments. For example, you can buy stocks for growth and use CFDs to offset potential losses in declining markets.

3. Broader Market Exposure

Combining platforms gives you exposure to multiple markets, enhancing your ability to build a diversified portfolio.

How to Get Started with Stock and CFD Trading Platforms

Ready to explore these platforms? Follow these steps to kickstart your trading journey:

1. Research and Compare Platforms

Take the time to compare features, fees, and reviews. Ensure the platform is regulated and trustworthy.

2. Open an Account

Most platforms have a straightforward sign-up process. You’ll need to provide identification and proof of address to verify your account.

3. Learn the Basics

Before diving in, familiarize yourself with trading concepts. Use demo accounts to practice and understand market dynamics.

4. Start Small

Begin with small investments and gradually scale up as you gain confidence and experience.

Conclusion: Are Stock and CFD Trading Platforms Worth It?

In today’s digital age, stock trading platforms and CFD trading platforms offer unmatched opportunities for investors. Their advantages include accessibility, cost-effectiveness, and powerful tools to enhance your trading experience. While CFD platforms require a higher level of expertise, they provide unique benefits for those willing to navigate their complexities.

Ultimately, choosing the right platform depends on your financial goals, risk tolerance, and level of experience. By leveraging the advantages of these platforms, you can take control of your financial future and unlock new investment opportunities.