Global Data Warehousing Industry: Key Statistics and Insights in 2024-2032

Summary:

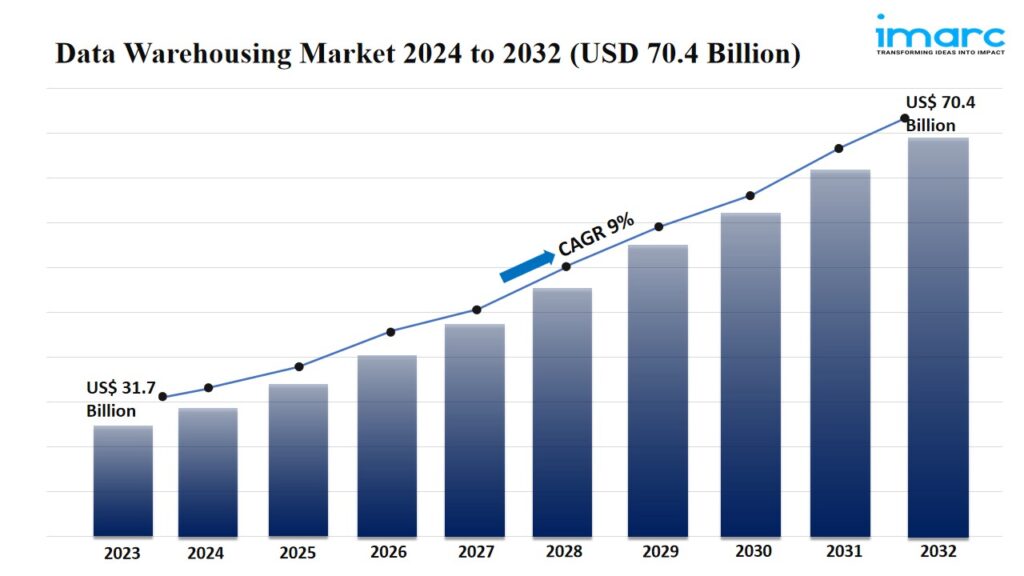

- The global data warehousing market size reached USD 31.7 Billion in 2023.

- The market is expected to reach USD 70.4 Billion by 2032, exhibiting a growth rate (CAGR) of 9% during 2024-2032.

- North America leads the market, accounting for the largest data warehousing market share.

- ETL solutions accounts for the majority of the market share in the offering segment due to their critical role in transforming and loading large volumes of data from various sources.

- Semi-structured and structured data hold the largest share in the data warehousing industry.

- On-premises remain a dominant segment in the market, driven by the rising need for greater control over data security and compliance.

- Large enterprises represent the leading enterprise size segment.

- BFSI holds the biggest data warehousing market share.

- The increasing data generation across industries is a primary driver of the data warehousing market.

- The adoption of cloud-based data warehousing and the integration of advanced technologies are reshaping the data warehousing market.

Industry Trends and Drivers:

- Increasing data generation across industries:

The rise in digitalization and the proliferation of connected devices is leading to an unprecedented increase in data generation across industries. Businesses are gathering massive amounts of data from various sources, including the internet of things (IoT) devices, e-commerce platforms, social media channels, and mobile applications. This vast influx of data requires robust storage solutions to manage and process it efficiently. Data warehousing systems provide a centralized platform for storing structured and unstructured data, ensuring it is readily accessible for analysis and reporting. The need to harness big data for actionable insights is encouraging companies to invest in data warehousing solutions to handle their growing data volumes. These systems enable real-time data processing and analysis, which helps organizations improve decision-making, optimize their operations, and personalize user interactions.

- Integration of advanced technologies:

The integration of advanced technologies like artificial intelligence (AI), machine learning (ML), and automation is driving the evolution of data warehousing. Modern data warehouses are becoming more intelligent, allowing businesses to automate data ingestion, transformation, and analysis processes. AI and ML can be applied to data warehouses to identify patterns, predict trends, and generate actionable insights faster than traditional methods. This enhanced analytical capability enables companies to make proactive decisions and respond to market changes more effectively. Additionally, automation reduces the need for manual data management tasks, freeing up resources for more strategic initiatives. Advanced data warehousing solutions, with the ability to handle vast amounts of data in real-time, also improving data quality, ensuring that insights are accurate and up-to-date.

- Adoption of cloud-based data warehousing:

The shift towards cloud computing is revolutionizing the data warehousing landscape, offering a scalable and cost-effective alternative to traditional on-premises systems. Cloud-based data warehousing solutions are becoming more popular due to their ability to scale storage and compute resources as needed without the notable upfront costs associated with physical infrastructure. This flexibility allows businesses to handle fluctuating data volumes and avoid over-provisioning resources. Cloud providers also offer integrated services, such as automated maintenance, security updates, and backups, freeing up information technology (IT) teams to focus on higher-value tasks. Additionally, cloud-based warehouses provide seamless integration with various cloud analytics and AI tools, enabling businesses to extract more value from their data.

Request PDF Sample for more detailed market insights: https://www.imarcgroup.com/data-warehousing-market/requestsample

Data Warehousing Market Report Segmentation:

Breakup By Offering:

- ETL Solutions

- Statistical Analysis

- Data Mining

- Others

ETL solutions exhibit a clear dominance in the market owing to their critical role in transforming and loading large volumes of data from various sources.

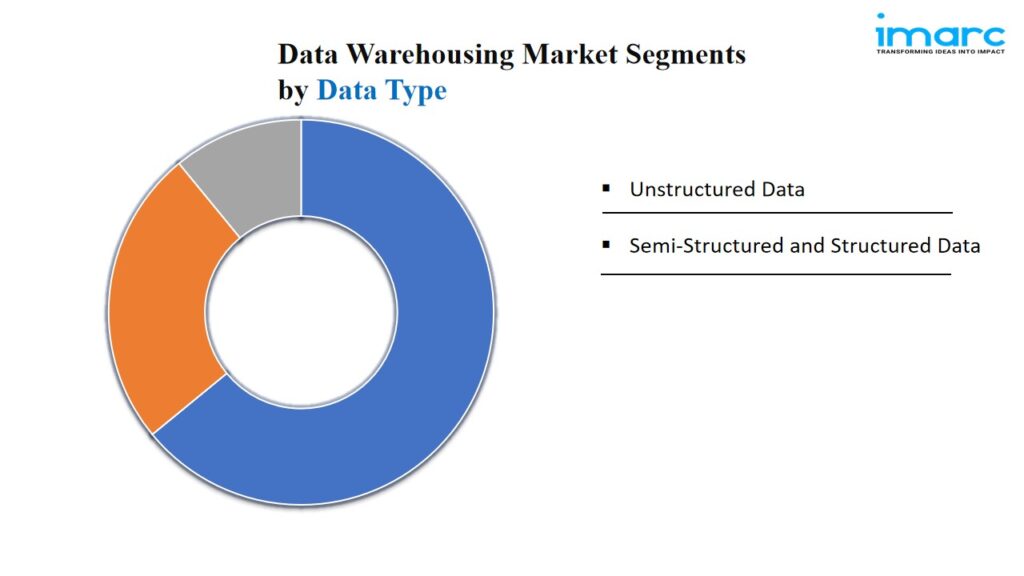

Breakup By Data Type:

- Unstructured Data

- Semi-Structured and Structured Data

Semi-structured and structured data represent the largest segment, as businesses rely on well-organized and easily accessible data for decision-making.

Breakup By Deployment Mode:

- On-premises

- Cloud-based

- Hybrid

On-premises holds the biggest market share accredited to the rising need for greater control over data security and compliance.

Breakup By Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises account for the majority of the market share due to their notable data management needs and complex infrastructure.

Breakup By End User:

- BFSI

- IT and Telecom

- Government

- Manufacturing

- Retail

- Healthcare

- Media and Entertainment

- Others

BFSI represents the largest segment attributed to the growing need for data warehousing solutions for regulatory compliance and risk management.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America dominates the market, driven by the early adoption of advanced technologies and a strong presence of key market players.

Top Data Warehousing Market Leaders:

The data warehousing market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- Actian Corporation (HCL Technologies Limited)

- Amazon Web Services Inc. (Amazon.com Inc)

- Cloudera Inc.

- Dell Technologies Inc.

- Google LLC (Alphabet Inc.)

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Snowflake Inc

- Teradata Corporation

Note: If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145