IMARC Group’s report titled “BFSI Crisis Management Market Report by Component (Software, Services), Deployment Type (On-premises, Cloud-based), Enterprises Size (Large Enterprises, Small and Medium-sized Enterprises), Application (Disaster Recovery and Business Continuity, Risk and Compliance Management, Crisis Communication, Incident Management and Response, and Others), End User (Banks, Insurance Companies, and Others), and Region 2024-2032“. The global BFSI crisis management market size reached US$ 15.8 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 61.9 Billion by 2032, exhibiting a growth rate (CAGR) of 15.8% during 2024-2032.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/bfsi-crisis-management-market/requestsample

Factors Affecting the Growth of the BFSI Crisis Management Industry:

- Cybersecurity Threats:

The BFSI sector faces an escalating cyber threat, including sophisticated attacks like ransomware and data breaches. These threats harm sensitive user data and financial stability. Crisis management solutions are crucial for swiftly identifying and mitigating cyber risks. By employing advanced threat intelligence, encryption protocols, and incident response frameworks, BFSI firms can fortify their cybersecurity posture. Additionally, proactive measures such as employee training, penetration testing, and vulnerability assessments help deter potential breaches. Effective crisis management not only safeguards user trust but also ensures compliance with data protection regulations.

- Regulatory Compliance:

Compliance requirements in the BFSI sector are stringent and constantly evolving, necessitating robust crisis management strategies. Non-compliance can result in hefty fines, legal repercussions, and reputational damage. Crisis management solutions streamline regulatory adherence by automating compliance workflows, conducting regular audits, and maintaining comprehensive documentation. Furthermore, these solutions enable real time monitoring of regulatory changes, facilitating prompt adjustments to policies and procedures. By fostering a culture of compliance and accountability, BFSI organizations can mitigate regulatory risks and demonstrate their commitment to ethical conduct and governance.

- Operational Resilience:

Operational disruptions, ranging from natural disasters to cyber incidents, can severely impact BFSI operations and client service. Crisis management solutions sustain operational resilience by establishing robust business continuity plans, redundant infrastructure, and disaster recovery mechanisms. Through scenario planning and tabletop exercises, organizations can identify vulnerabilities and devise proactive strategies for mitigating operational risks. Additionally, cloud-based solutions offer scalability and flexibility, ensuring seamless continuity of operations during crises. By prioritizing operational resilience, BFSI firms can minimize downtime, preserve customer trust, and uphold their reputation as reliable service providers.

Leading Companies Operating in the Global BFSI Crisis Management Industry:

- 4C Group AB

- Beekeeper AG

- Everbridge Inc.

- International Business Machines Corporation

- Logicgate Inc.

- Metricstream Inc.

- NCC Group

- Noggin Pty Ltd

- Rockdove Solutions Inc.

- Sas Institute Inc.

- Software Aktiengesellschaft

- Veoci Inc.

BFSI Crisis Management Market Report Segmentation:

By Component:

- Software

- Services

On the basis of the component, the market has been bifurcated into software and services.

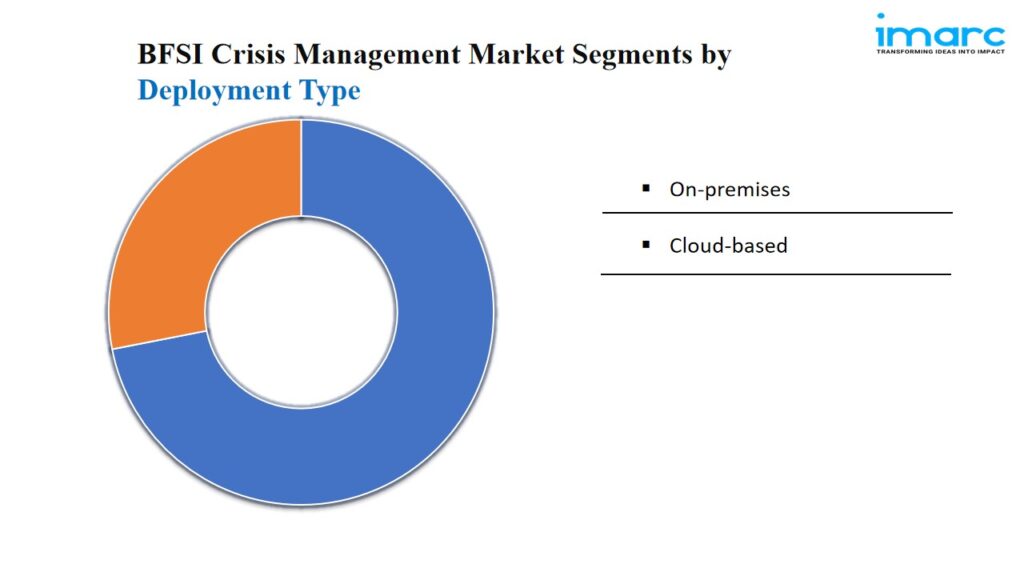

By Deployment Type:

- On-premises

- Cloud-based

On-premises hold the biggest market share as they offer organizations direct control over their data and systems, addressing concerns about data sovereignty, regulatory compliance, and security.

By Enterprises Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises account for the largest market share due to the rising focus on managing diverse product portfolios.

By Application:

- Disaster Recovery and Business Continuity

- Risk and Compliance Management

- Crisis Communication

- Incident Management and Response

- Others

Incident management and response represent the largest segment on account of the increasing frequency of cyberattacks.

By End User:

- Banks

- Insurance Companies

- Others

Banks exhibit a clear dominance in the market, driven by their extensive operations, significant assets under management, and broad client base.

Regional Insights:

- North America: (United States, Canada)

- Asia Pacific: (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe: (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America: (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys a leading position in the BFSI crisis management market, which can be attributed to a favorable regulatory environment.

Global BFSI Crisis Management Market Trends:

Technologies, such as artificial intelligence (AI), machine learning (ML), and blockchain, are transforming the BFSI landscape. Crisis management tools leverage advanced technologies to identify emerging threats, enhance decision-making, and strengthen cybersecurity defenses.

In addition, negative incidents, such as data breaches or compliance failures, can trigger a public backlash and erode trust. Crisis management solutions play a pivotal role in safeguarding reputation by facilitating swift and transparent communication, stakeholder engagement, and brand protection measures. Proactive reputation monitoring and sentiment analysis enable organizations to detect emerging threats and preemptively address issues before they escalate.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARCs information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the companys expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145