Automotive Aluminum Market Overview:

The global automotive aluminum market size reached US$ 30.3 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 59.6 Billion by 2032, exhibiting a growth rate (CAGR) of 7.6% during 2024-2032.

Global Automotive Aluminum Companies

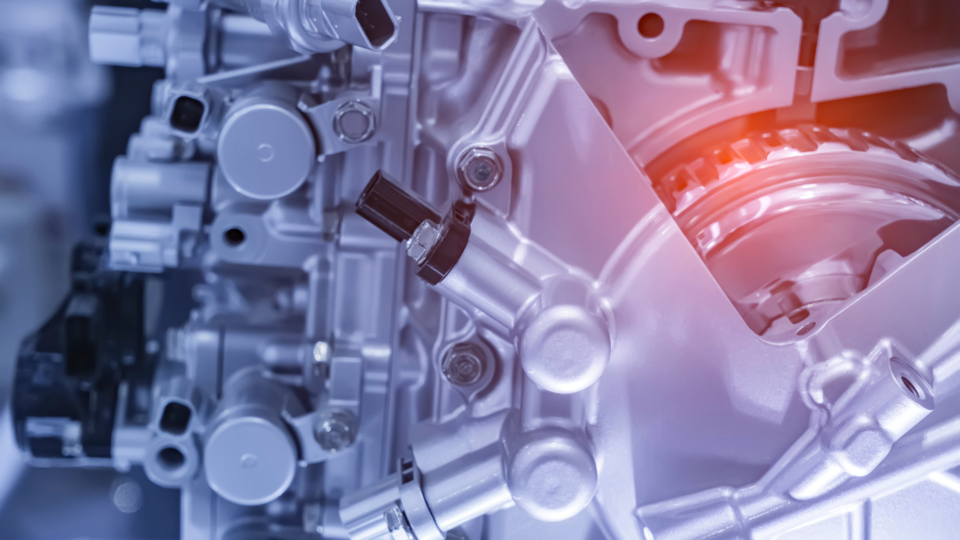

Automotive aluminum is used in the production of vehicles. It is well-known for its lightweight qualities, strength, and corrosion resistance, making it suitable for a wide range of automotive applications. It can enhance fuel efficiency and lower greenhouse gas emissions by reducing the overall weight of the vehicle. It is also extremely recyclable, making it a better choice for the environment than other materials. It is suitable for usage in the vehicle’s chassis, wheels, radiators, and body panels. Furthermore, automotive aluminum provides greater design flexibility than heavier metals such as steel, allowing to produce sleeker and more aerodynamic vehicle designs. Aluminum’s recyclability enhances its appeal in the automotive industry, harmonizing with worldwide tendencies toward sustainability and circular economy production techniques. The increasing need for lightweight cars due to rapid urbanization and inflating income levels is strengthening the growth of the market. In 2023, the worldwide luxury car market was valued at $449.5 billion. Looking ahead, IMARC Group estimates the market to reach US$ 657.8 billion by 2032, with a compound annual growth rate (CAGR) of 4.1% from 2024 to 2032.

Top 16 Automotive Aluminum Companies:

- Alcoa Inc.

- Novelis

- Rio Tinto Alcan

- Constellium

- BHP

- AMG Advanced Metallurgical

- UACJ Corporation

- Norsk Hydro ASA

- Dana Holding Corporation

- Progress-Werk Oberkirch AG

- Jindal Aluminium

- Kaiser Aluminum

- Lorin Industries

- Tenneco Inc.

- ElringKlinger AG

- ThermoTec Automotive

Request the Sample Report: https://www.imarcgroup.com/automotive-aluminium-market/requestsample

Leading businesses are producing high-strength aluminum alloys with higher tensile strength and fatigue life, making them perfect for essential structural components and allowing manufacturers to design thinner, lighter parts while maintaining safety and durability. For example, in 2023, Novelis announced the launch of a new roll forming development line capable of producing huge quantities of high-strength aluminum auto parts. Furthermore, in August 2023, Hydro announced an investment of NOK 67 million (about EUR 6 million) to improve its aluminum extrusion facility in Lucé, France. Moreover, in August 2023, Hydro declared an investment of NOK 67 million (approximately EUR 6 million) to enhance its aluminum extrusion facility in Lucé, France. This investment was earmarked for the modernization of the plant’s equipment, buildings, and infrastructure and for initiating a new program dedicated to employee development. Besides, key players are using computer-aided design (CAD) technologies to create automobile aluminum components. This also helps engineers to tune material qualities for specific applications, resulting in lighter and more lasting components. Furthermore, prominent manufacturers are combining aluminum with other materials such as carbon fiber composites or high-strength steel to provide the lightweight properties of aluminum while maintaining the strength of other materials.

Browse Our Other Reports: