Employee Stock Ownership Plans (ESOPs) have gained popularity among companies in Singapore as a way to incentivize and reward employees. ESOPs allow employees to become partial owners of the company, aligning their interests with those of the business. However, to effectively implement an ESOP, a crucial step is determining the valuation of the company’s shares. This process can be complex and requires the expertise of professionals who understand the nuances of ESOP valuation in Singapore.

Table of Contents

What is ESOP Valuation?

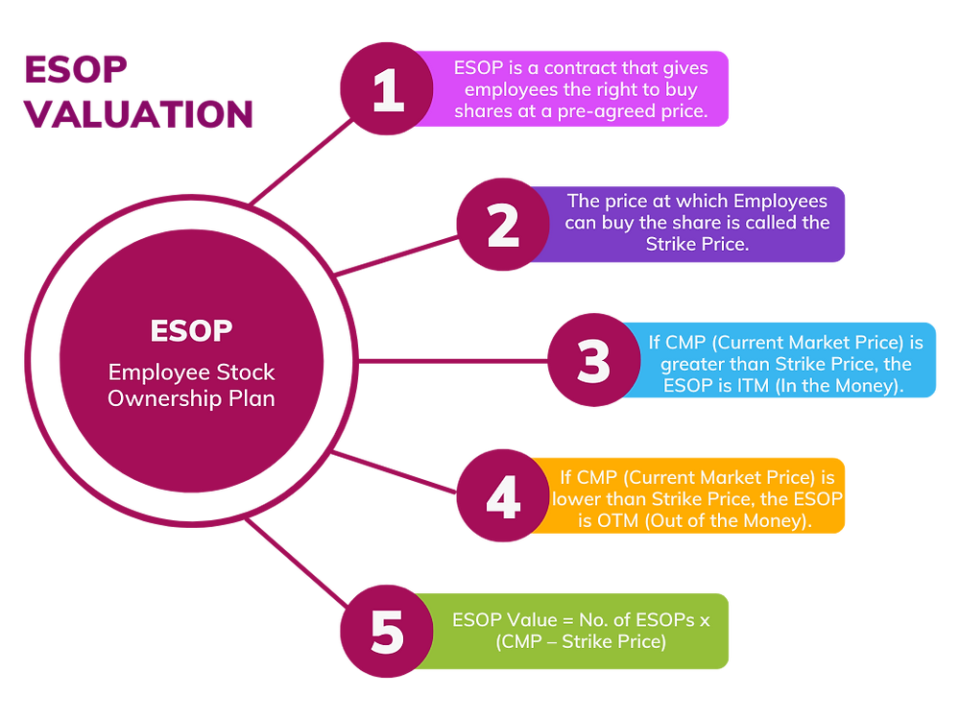

ESOP valuation is the process of determining the fair market value of a company’s shares that will be allocated to employees as part of an Employee Stock Ownership Plan. This valuation serves as the foundation for the distribution of shares to employees and plays a pivotal role in the success of the ESOP.

Why is ESOP Valuation Important?

1. Equity Distribution: Accurate valuation ensures that employees receive a fair share of equity in the company.

2. Tax Compliance: ESOP valuations must comply with Singapore’s tax regulations to avoid any legal issues.

3. Employee Motivation: Proper valuation motivates employees by showing the value of their ownership stakes.

4. Financial Planning: It aids in financial planning and decision-making for the company and its employees.

Choosing the Best ESOP Valuation Experts in Singapore

Given the significance of ESOP valuation, selecting the right experts is essential. Here’s how to identify the best ESOP valuation experts in Singapore:

1. Experience: Look for professionals or firms with a proven track record in ESOP valuations. Their experience can be invaluable in navigating the complexities of the process.

2. Certifications: Ensure that the experts hold relevant certifications and qualifications in valuation, accounting, and finance.

3. Knowledge of Local Regulations: Singapore has specific regulations regarding ESOPs. The best experts should have in-depth knowledge of these regulations to ensure compliance.

4. Transparent Process: Experts should have a transparent valuation process, explaining their methodologies and assumptions clearly.

5. Customized Solutions: Choose experts who offer customized solutions tailored to your company’s unique needs and circumstances.

ESOP Valuation Services in Singapore

In Singapore, you’ll find a range of ESOP valuation services, including:

1. ESOP Valuation Companies: Firms that specialize in ESOP valuations and offer comprehensive services.

2. ESOP Advisory: Consultancy services providing guidance on ESOP implementation and valuation strategies.

3. ESOP Accounting: Experts who can assist with the accounting aspects of ESOPs.

4. ESOP Structuring: Professionals who can help design the ESOP plan to align with your company’s objectives.

Valueteam – ESOP Valuation Experts in Singapore

Valueteam is a well-established name in ESOP valuation in Singapore. With a team of experienced professionals, they offer expert valuation services tailored to your company’s needs. Their commitment to accuracy, compliance, and transparency makes them a top choice for ESOP valuation in the region.

In conclusion, ESOP valuation is a critical step in implementing an Employee Stock Ownership Plan in Singapore. To ensure a smooth and successful process, it’s essential to partner with the best ESOP valuation experts who understand local regulations and can provide customized solutions for your company’s unique circumstances. Valueteam and other reputable firms in Singapore offer the expertise needed to navigate the complexities of ESOP valuation effectively.

Read More – Making Learning Skill a Regular Part of Life is Valuable