Source: IMARC Group | Category: News | Author Name: Abhishek Rastogi

Report Introduction

According to IMARC Group’s latest report titled “Malaysia ATM Market Size, Share, Trends and Forecast by Solution, ATM Type, Screen Size, Application, and Region, 2025-2033”, this study offers a granular analysis of the banking automation landscape in Southeast Asia’s growing digital economy. This research report offers a profound analysis of the industry, encompassing Malaysia ATM market size, share, growth factors, key trends, and regional insights. The report covers critical market dynamics, including the transition towards Smart ATMs and Cash Recycling Machines (CRMs), the strategic expansion of Independent ATM Deployers (IADs), and the integration of biometric security features to enhance user trust.

Market At-A-Glance: Key Statistics (2025-2033):

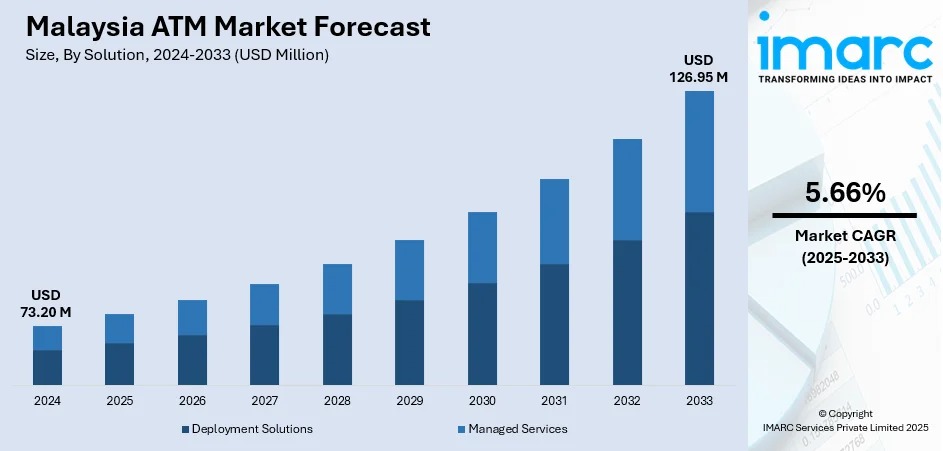

- Current Market Size (2024): USD 73.20 Million

- Projected Market Size (2033): USD 126.95 Million

- Growth Rate (CAGR): 5.66%

- Dominant Region: Selangor (Central Region) due to high density of banking networks.

Note: We are in the process of updating our reports to cover the 2026–2034 forecast period. For the most recent data, market insights, and industry updates, please click on ‘Request Free Sample Report’.

Request Free Sample Report (Exclusive Offer on Corporate Email): https://www.imarcgroup.com/malaysia-atm-market/requestsample

Malaysia ATM Market Overview

The Malaysia ATM market size reached USD 73.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 126.95 Million by 2033, exhibiting a stable growth rate (CAGR) of 5.66% during 2025-2033.

The market is witnessing a strategic evolution, balancing the rapid adoption of digital payments (like DuitNow) with the enduring need for cash accessibility. While volume growth in traditional cash dispensers stabilizes, value growth is driven by the replacement cycle where banks upgrade legacy machines to Smart ATMs and ITMs (Interactive Teller Machines). These advanced units offer services beyond cash withdrawal, such as bill payments, fund transfers, and check deposits, effectively acting as “mini-branches.” Furthermore, the push for financial inclusion in rural areas of Sabah and Sarawak continues to necessitate physical banking touchpoints, ensuring steady demand for durable, off-site ATM installations.

Top Emerging Trends in the Malaysia ATM Market:

- Cash Recycling Machines (CRMs): Rapid adoption of CRMs which accept cash deposits and recycle them for withdrawals, significantly reducing cash-in-transit (CIT) costs for banks.

- Biometric Authentication: Integration of fingerprint and facial recognition technology to enhance security and allow cardless withdrawals.

- Independent ATM Deployers (IADs): The market is seeing consolidation and expansion of non-bank operators, exemplified by Euronet’s strategic acquisition of MEPS terminals, enhancing efficiency in off-site locations.

- Contactless Transactions: Rising use of NFC-enabled ATMs that allow users to withdraw cash using their smartphones or contactless cards, minimizing physical contact.

- Branch Transformation: Banks are reducing physical branch sizes and replacing teller counters with multi-function kiosks to optimize operational costs.

Malaysia ATM Market Growth Factors (Drivers)

- Tourism Recovery: As a major tourist destination, Malaysia sees consistent demand for cash access from international travelers, supporting high usage rates in transport hubs and retail centers.

- Financial Inclusion Mandates: Regulatory pressure to ensure banking access in underserved rural districts drives the deployment of low-cost, ruggedized ATMs.

- Operational Efficiency: Banks are aggressively deploying self-service terminals to automate routine transactions, freeing up staff for high-value advisory roles.

- Safety & Security: Demand for advanced anti-skimming devices and software security upgrades drives the market for hardware modernization.

Market Segmentation

Analysis by Solution:

- Deployment Solutions (Onsite, Offsite, Work Site, Mobile)

- Managed Services (Growing segment as banks outsource ATM fleet maintenance)

Analysis by ATM Type:

- Conventional/Bank ATMs

- Brown Label ATMs

- White Label ATMs

- Smart ATMs (Fastest growing segment)

- Cash Dispensers

Analysis by Application:

- Withdrawals

- Transfers

- Deposits (Driven by CRM adoption)

Regional Insights:

- Central Region (Selangor, KL): Hub of commercial banking activities.

- Northern Region (Penang, Perak)

- Southern Region (Johor)

- East Coast & East Malaysia (Sabah, Sarawak): Focus areas for rural expansion.

Malaysia ATM Market Recent Developments & News

- June 2024: Euronet Worldwide completed the acquisition of the Malaysian Electronic Payment System (MEPS) ATM terminals from PayNet, making it the largest non-bank ATM operator in the country.

- Technological Upgrades: Major banks like Maybank and CIMB continue to upgrade their fleets with CRM capabilities to support sustainability goals by reducing armored carrier trips.

- Regulatory Compliance: New guidelines on cybersecurity resilience are prompting hardware and software refreshes across aging ATM networks.

Why Buy This Report? (High-Value Insights)

- Granular Segmentation: Detailed analysis of Onsite vs. Offsite profitability, helping deployers optimize location strategies.

- Regional Hotspots: In-depth breakdown of demand in tourist hubs vs. rural districts, identifying specific installation opportunities.

- Future-Ready Trends: Insights into the commercial viability of Crypto-enabled ATMs, highlighting niche growth avenues.

Key Highlights of the Report

- Market Forecast (2025-2033): Quantitative data on market value and steady growth trajectory.

- Competitive Landscape: Comprehensive analysis of OEM manufacturers versus third-party service providers.

- Strategic Analysis: Porter’s Five Forces analysis and value chain assessment.

- Technological Trends: Insights into advancements in predictive maintenance software for ATM fleets.

Customization Note: If you require specific data we can provide it as part of our customization services.