Source: IMARC Group | Category: Transportation and Logistics | Author Name: Abhishek Rastogi

Report Introduction

According to IMARC Group’s latest report titled “Indonesia E-Commerce Logistics Market Size, Share, Trends and Forecast by Service, Business, Destination, Product, and Region, 2026-2034”, this study offers a granular analysis of the archipelago’s rapidly evolving digital supply chain. The study offers a profound analysis of the industry, encompassingIndonesia e-commerce logistics market size, share, growth factors, key trends, and regional insights. The report covers critical market dynamics, including the impact of the booming e-commerce sector, the challenges of last-mile delivery across thousands of islands, and the increasing adoption of green logistics practices.

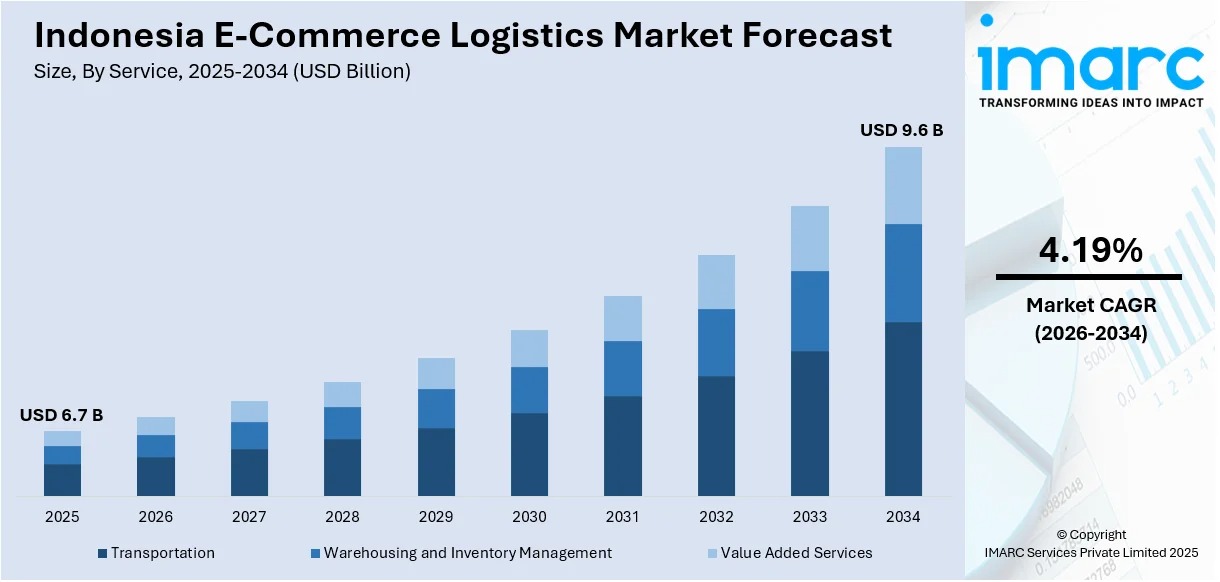

Market At-A-Glance: Key Statistics (2026-2034):

- Current Market Size (2025): USD 6.7 Billion

- Projected Market Size (2034): USD 9.6 Billion

- Growth Rate (CAGR): 4.19%

- Dominant Region: Java (Implicit from high economic concentration and infrastructure development)

Request Free Sample Report (Exclusive Offer on Corporate Email): https://www.imarcgroup.com/indonesia-e-commerce-logistics-market/requestsample

Indonesia E-Commerce Logistics Market Overview

The Indonesia e-commerce logistics market size reached USD 6.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 9.6 Billion by 2034, exhibiting a stable growth rate (CAGR) of 4.19% during 2026-2034.

The market is witnessing a structural shift, primarily driven by the exponential growth of online retail platforms like Shopee, Tokopedia, and Lazada. As internet penetration deepens, consumers in remote islands are increasingly participating in the digital economy, creating a massive demand for reliable logistics networks that can handle complex geographical challenges. Logistics providers are responding by optimizing delivery routes using data analytics and establishing decentralized fulfillment centers to reduce shipping times. Furthermore, there is a rising focus on sustainable logistics, with companies adopting electric vehicles for last-mile delivery and utilizing eco-friendly packaging to meet the demands of environmentally conscious consumers. The expansion of secure digital payment gateways is also reducing the reliance on Cash on Delivery (COD), streamlining operations.

Top Emerging Trends in the Indonesia E-Commerce Logistics Market:

- Data-Driven Optimization: Logistics providers are increasingly leveraging data analytics generated from e-commerce systems to optimize operations, forecast demand, and analyze customer behavior for better service delivery.

- Eco-Friendly Practices: There is a rising adoption of green logistics solutions and sustainable transportation options to reduce carbon footprints and minimize packaging waste in the supply chain.

- Faster Delivery Models: The demand for accelerated shipping options, such as same-day and next-day delivery, is reshaping service models and pushing providers to enhance speed and efficiency.

- International Logistics Focus: A growing need for efficient cross-border solutions, including customs clearance and international shipping, is emerging to support the expanding global reach of Indonesian e-commerce businesses.

- Secure Payment Integration: The wide availability and integration of secure, convenient online payment solutions are streamlining transactions, providing lucrative growth opportunities for logistics investors.

Indonesia E-Commerce Logistics Market Growth Factors (Drivers)

- Booming Online Retail: The rapid increase in online shopping adoption among Indonesian consumers is the primary engine driving the escalating demand for robust and efficient e-commerce logistics services.

- Remote Region Order Volume: Rising order volumes from remote and distant locations are compelling logistics companies to expand their reach and optimize delivery networks to service these underserved areas effectively.

- Infrastructure Development: Significant investments in logistics infrastructure, such as new warehouses and transportation hubs, are enhancing the overall efficiency and capacity of the e-commerce supply chain.

- Consumer Service Expectations: Evolving consumer expectations for quicker shipping, transparent tracking, and hassle-free returns are pushing logistics providers to innovate and improve their service offerings.

- Digital Payment Ecosystem: The proliferation of secure digital payment gateways simplifies the purchasing process, directly boosting e-commerce transaction volumes and subsequently increasing the demand for logistics support.

Market Segmentation

Analysis by Service:

- Transportation (Dominant segment due to the geographical complexity of the archipelago)

- Warehousing and Inventory Management

- Value Added Services

Analysis by Business:

- B2C (Leading segment driven by direct consumer purchases on marketplaces)

- B2B

Analysis by Destination:

- Domestic (Largest share due to high internal consumption)

- International/Cross-border

Analysis by Product:

- Fashion and Apparel (Major volume driver)

- Consumer Electronics

- Home Appliances

- Furniture

- Beauty and Personal Care Products

- Others

Regional Insights:

- Java: The economic heartland with the highest concentration of e-commerce users and logistics infrastructure.

- Sumatra

- Kalimantan

- Sulawesi

- Others

Indonesia E-Commerce Logistics Market Recent Developments & News

- Digital Integration: Major logistics players are integrating with super-apps to offer seamless delivery options to consumers.

- Infrastructure Investment: Logistics companies are expanding their warehouse footprint in Tier-2 and Tier-3 cities to speed up last-mile delivery.

- Partnerships: Collaborations between e-commerce platforms and logistics providers to offer subsidized shipping rates and loyalty programs.

Why Buy This Report? (High-Value Insights)

- Granular Segmentation: Detailed analysis of Domestic vs. Cross-border logistics trends, helping companies tap into the export market.

- Regional Hotspots: In-depth breakdown of logistics challenges in Java vs. Outer Islands, aiding in network planning.

- Future-Ready Trends: Insights into the adoption of Drone Delivery for remote areas, highlighting the next frontier of island logistics.

Key Highlights of the Report

- Market Forecast (2026-2034): Quantitative data on market value and steady growth.

- Competitive Landscape: Comprehensive analysis of key market players and their service expansion strategies.

- Strategic Analysis: Porter’s Five Forces analysis and value chain assessment.

- Technological Trends: Insights into advancements in automated sorting centers.

Customization Note: If you require specific data we can provide it as part of our customization services.