Source: IMARC Group | Category: Energy & Mining | Author Name: Abhishek Rastogi

Report Introduction

According to IMARC Group’s latest report titled “India Oil and Gas Downstream Market Size, Share, Trends and Forecast by Type, Distribution, and Region, 2025-2033″, this study offers a granular analysis of the nation’s critical energy infrastructure. This keyword research report offers a profound analysis of the industry, encompassing market share, size, growth factors, key trends, and regional insights. The report covers critical market dynamics, including the massive expansion of refining capacity to meet the 310 MMTPA target by 2028, the accelerated adoption of ethanol blended petrol (E20), and the digital transformation of fuel retail networks via automation and IoT.

Market At-A-Glance: Key Statistics (2025-2033):

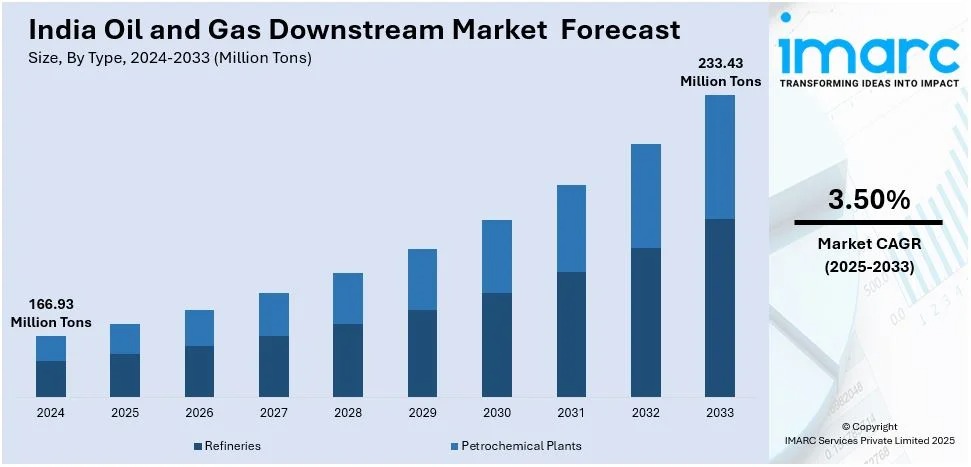

- Current Market Size (2024): 166.93 Million Tons

- Projected Market Size (2033): 233.43 Million Tons

- Growth Rate (CAGR): 3.50%

- Dominant Region: West India (Implicit from the concentration of major refineries like Jamnagar and Vadinar).

Note: We are in the process of updating our reports to cover the 2026–2034 forecast period. For the most recent data, market insights, and industry updates, please click on ‘Request Free Sample Report’.

Request Free Sample Report (Exclusive Offer on Corporate Email): https://www.imarcgroup.com/india-oil-gas-downstream-market/requestsample

India Oil and Gas Downstream Market Overview

The India oil and gas downstream market size reached 166.93 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 233.43 Million Tons by 2033, exhibiting a steady growth rate (CAGR) of 3.50% during 2025-2033.

The market is witnessing resilient growth, anchored by the nation’s rising energy demand fueled by industrial expansion and increasing vehicle ownership. The government’s strategic push to expand domestic refining capacity—aiming for 450 MMTPA by 2030—is a primary driver, ensuring self-sufficiency and positioning India as a global refining hub. Concurrently, the sector is undergoing a “green shift,” with aggressive targets for ethanol blending (E20 by 2025) and the integration of Green Hydrogen in refinery processes. Furthermore, the modernization of fuel retail outlets with automation, EV charging stations, and CNG dispensing is transforming traditional petrol pumps into comprehensive energy hubs.

Top Emerging Trends in the India Oil and Gas Downstream Market:

- Refinery-Petrochemical Integration: Major players are integrating petrochemical complexes with refineries to maximize value addition and hedge against volatile fuel margins.

- Digitalization of Operations: Widespread adoption of AI, Digital Twins, and Predictive Maintenance in refineries and pipelines to optimize operational efficiency and reduce downtime.

- Ethanol Blending Program: The accelerated rollout of E20 fuel is reshaping the supply chain, requiring infrastructure upgrades for storage and blending at terminals.

- Smart Fuel Retailing: Introduction of automated fuel stations with loyalty programs, RFID payments, and non-fuel retail offerings to enhance customer experience.

- City Gas Distribution (CGD) Expansion: Rapid expansion of the CGD network to connect millions of households with PNG (Piped Natural Gas) and expand CNG infrastructure.

India Oil and Gas Downstream Market Growth Factors (Drivers)

- Rising Energy Consumption: India’s status as the world’s third-largest energy consumer ensures a sustained demand baseline for petrol, diesel, and LPG.

- Infrastructure Investments: Massive government spending on pipeline networks (e.g., Urja Ganga) and new storage terminals improves distribution efficiency.

- Government Policies: Supportive policies like the PM Ujjwala Yojana (for LPG) and deregulation of fuel prices encourage private sector participation and market competition.

- Automotive Sector Growth: Despite the EV shift, the massive existing fleet of ICE vehicles guarantees continued demand for transport fuels in the medium term.

- Strategic Location: India’s proximity to key Middle Eastern crude sources and growing Asian demand centers positions it ideally for export-oriented refining.

Market Segmentation

Analysis by Type:

- Refineries (Dominant segment due to capacity expansion projects)

- Petrochemical Plants

Analysis by Distribution:

- Retail (Largest segment driven by widespread fuel station network)

- Wholesale

- Commercial

Regional Insights:

- West India (Hub of refining capacity with major private and public refineries)

- North India (High consumption density)

- South India

- East India (Focus of new pipeline and refinery projects)

India Oil and Gas Downstream Market Recent Developments & News

- February 2025: Government announced new licensing rounds to boost domestic hydrocarbon output and reduce import dependence.

- August 2024: Oil India Ltd. announced plans to triple capacity at the Numaligarh Refinery and venture into green hydrogen and bio-ethanol.

- Strategic Projects: Progress on the 60 MMTPA Ratnagiri Refinery and Petrochemical Complex (RRPCL) continues, set to be one of the world’s largest integrated complexes.

Why Buy This Report? (High-Value Insights)

- Granular Segmentation: Detailed analysis of Retail vs. Commercial fuel demand, helping OMCs optimize their distribution strategies.

- Regional Hotspots: In-depth breakdown of capacity expansion in East India vs. West India, identifying emerging investment zones.

- Future-Ready Trends: Insights into the commercial viability of Bio-Jet Fuel (SAF) production, highlighting the next frontier for Indian refiners.

Key Highlights of the Report

- Market Forecast (2025-2033): Quantitative data on market volume and steady growth trajectory.

- Competitive Landscape: Comprehensive analysis of PSU giants versus private sector majors.

- Strategic Analysis: Porter’s Five Forces analysis and value chain assessment.

- Technological Trends: Insights into advancements in hydrocracking and desulfurization technologies.

Customization Note: If you require specific data we can provide it as part of our customization services.