Source: IMARC Group | Category: News | Author Name: Abhishek Rastogi

Report Introduction

According to IMARC Group’s latest report titled “Malaysia and Indonesia Takaful Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033”, the research report offers a profound analysis of the industry, encompassing the Malaysia and Indonesia Takaful market size, share, growth factors, key trends, and regional insights. The report covers critical market dynamics, including the impact of the Indonesian Financial Services Authority’s (OJK) spin-off requirements for Sharia units, the mature regulatory framework of Malaysia’s IFSA 2013, and the rapid adoption of InsurTech to deepen market penetration.

Market At-A-Glance: Key Statistics (2025-2033):

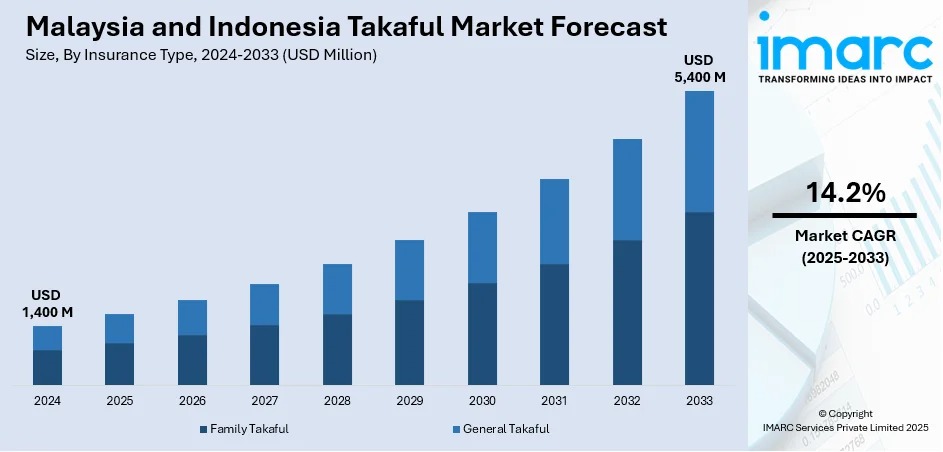

- Current Market Size (2024): USD 1,400 Million

- Projected Market Size (2033): USD 5,400 Million

- Growth Rate (CAGR): 14.2%

- Dominant Market: Malaysia (Currently holds the majority share due to a more mature ecosystem).

- Leading Key Players: AIA Group Limited, Asia Capital Reinsurance Group Pte. Ltd. (Catalina Holdings (Bermuda) Ltd.), Etiqa General Takaful Berhad, Hong Leong Msig Takaful Berhad, MAA Group Berhad, Munich Re Group, Prudential BSN Takaful Berhad, Sun Life Malaysia, Syarikat Takaful Malaysia Keluarga Berhad, Takaful IKHLAS (MNRB Holdings Berhad)

Note: We are in the process of updating our reports to cover the 2026–2034 forecast period. For the most recent data, market insights, and industry updates, please click on ‘Request Free Sample Report’.

Request Free Sample Report (Exclusive Offer on Corporate Email): https://www.imarcgroup.com/malaysia-indonesia-takaful-market/requestsample

Malaysia and Indonesia Takaful Market Overview

The Malaysia and Indonesia Takaful market size reached USD 1,400 million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,400 million by 2033, exhibiting an impressive growth rate (CAGR) of 14.2% during 2025-2033.

The market is witnessing robust growth, driven by the expanding Muslim population in both nations, who are increasingly seeking Shariah-compliant financial protection. Malaysia remains the regional hub with a highly developed regulatory infrastructure, while Indonesia presents massive untapped potential due to its low insurance penetration rate. A significant driver is the growing awareness of ethical finance and the “risk-sharing” model, which appeals even to non-Muslim consumers. Furthermore, the mandatory spin-off of Sharia business units in Indonesia by 2026 is catalyzing structural changes, encouraging independent Takaful operators to innovate and expand their reach.

Top Emerging Trends in the Malaysia and Indonesia Takaful Market:

- Digital Takaful (InsurTech): Rapid integration of mobile apps and AI-driven platforms to offer micro-takaful products, making insurance accessible to the unbanked population in rural Indonesia and Malaysia.

- Micro-Takaful Expansion: Development of affordable, “bite-sized” protection plans catering to the B40 income group, supported by government initiatives like Perlinda in Malaysia.

- ESG Alignment: Increasing convergence between Takaful principles (Maqasid Shariah) and Environmental, Social, and Governance (ESG) criteria, attracting socially conscious investors.

- Product Innovation: Shift from traditional general takaful to investment-linked products (ILP) and specialized coverage for modern risks like cyber security and pandemic-related health issues.

- Value-Based Intermediation (VBI): Malaysian operators are adopting VBI strategies to deliver positive social impact, moving beyond mere Shariah compliance to holistic value creation.

Malaysia and Indonesia Takaful Market Growth Factors (Drivers)

- Demographic Dividend: Indonesia has the world’s largest Muslim population, and Malaysia has a Muslim-majority demographic, creating a natural and vast customer base for Shariah-compliant products.

- Regulatory Support: Strong government backing, such as Bank Negara Malaysia’s Value-Based Intermediation framework and Indonesia’s Masterplan for Sharia Economy, provides a stable growth environment.

- Spin-Off Mandates: Indonesia’s requirement for Sharia units to spin off into standalone entities is forcing capital injection and strategic focus, boosting market competitiveness.

- Rising Disposable Income: Economic growth in Southeast Asia is leading to a rising middle class with greater capacity to purchase life and general protection plans.

- Low Penetration Rates: The relatively low insurance penetration in Indonesia compared to regional peers offers significant “catch-up” growth potential.

Market Segmentation

Analysis by Product Type:

- Family Takaful (Dominant segment, equivalent to Life Insurance, driven by savings and protection needs)

- General Takaful (Motor, Fire, Marine, etc.)

Analysis by Distribution Channel:

- Agency (Historically dominant for complex family products)

- Bancatakaful (Fastest growing due to bank partnerships)

- Online/Digital

- Others

Regional Insights:

- Malaysia (Mature market, high penetration of Family Takaful)

- Indonesia (High growth potential, regulatory transition phase)

Malaysia and Indonesia Takaful Market Recent Developments & News

- Regulatory Deadlines: Indonesia’s OJK has set strict deadlines for the separation of Sharia business units, prompting a wave of corporate restructuring and new entity formations.

- Digital Partnerships: Major players like Zurich Malaysia and Takaful Malaysia are partnering with fintech firms and e-wallets (e.g., Grab, Gojek) to distribute micro-takaful products.

- Mergers & Acquisitions: Consolidation activities are expected to rise, particularly in Indonesia, as smaller units merge to meet capital requirements for spin-offs.

Why Buy This Report? (High-Value Insights)

- Granular Segmentation: Detailed analysis of Family vs. General Takaful adoption trends, helping insurers align their product portfolios with demographic needs.

- Country-Specific Analysis: In-depth breakdown of the Malaysian regulatory landscape vs. Indonesian growth opportunities, aiding in cross-border expansion strategies.

- Future-Ready Trends: Insights into the commercial viability of Blockchain in Takaful for transparent claims processing and surplus distribution.

Key Highlights of the Report

- Market Forecast (2025-2033): Quantitative data on market value and rapid growth trajectory.

- Competitive Landscape: Comprehensive analysis of standalone Takaful operators versus Islamic windows.

- Strategic Analysis: Porter’s Five Forces analysis and value chain assessment.

- Technological Trends: Insights into advancements in digital distribution channels.

Customization Note: If you require specific data we can provide it as part of our customization services.