Source: IMARC Group | Category: Food & Beverages | Author Name: Abhishek Rastogi

Report Introduction

According to IMARC Group’s latest report titled “India Spices Market Size, Share, Trends and Forecast by Product Type, Application, Form, and Region, 2026-2034”, this study offers a granular analysis of the world’s largest spice producer and consumer. This keyword research report offers a profound analysis of the spice industry size in india, encompassing market share, growth factors, key trends, and regional insights. The report covers critical market dynamics, including the shift towards packaged and branded spices to ensure hygiene, the rising demand for organic and ayurvedic spices, and the government’s push for value-added spice exports through Spices Board initiatives.

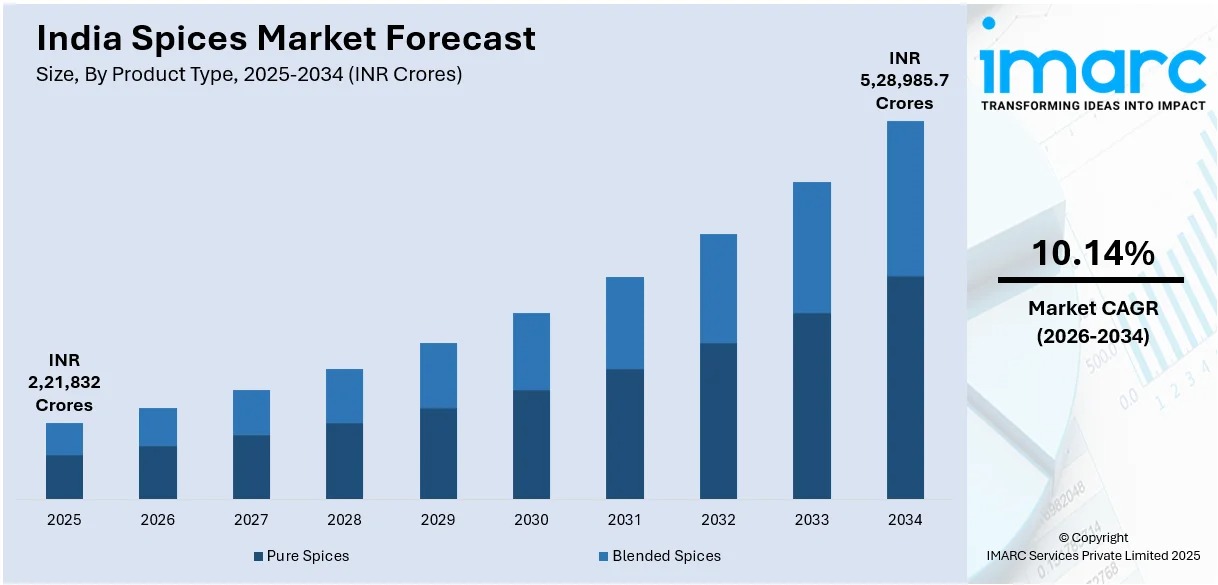

Market At-A-Glance: Key Statistics (2026-2034):

- Current Market Size (2025): INR 2,21,832 Crores

- Projected Market Size (2034): INR 5,28,985.7 Crores

- Growth Rate (CAGR): 10.14%

- Dominant Region: South India (Dominates cultivation of key spices like cardamom, pepper, and turmeric due to ideal tropical climate).

- Leading Key Players: Aachi Masala Foods (P) Ltd, Aashirvaad Spices (ITC Limited), Badshah Masala, Catch Foods (DS Group), Everest Food Products Private Limited, Goldiee Group, Mahashian Di Hatti Private Limited, Orkla India Pvt Ltd., Patanjali Ayurved Limited

Request Free Sample Report (Exclusive Offer on Corporate Email): https://www.imarcgroup.com/india-spices-market/requestsample

India Spices Market Overview

The India spices market size reached INR 2,21,832 Crores in 2025. Looking forward, IMARC Group expects the market to reach INR 5,28,985.7 Crores by 2034, exhibiting a double-digit growth rate (CAGR) of 10.14% during 2026-2034.

The market is witnessing a robust transformation from loose, unbranded sales to packaged, branded products, driven by growing health consciousness and rapid urbanization. Consumers are increasingly wary of adulteration in open markets, prompting a switch to trusted brands that offer standardized quality and convenient packaging (e.g., zip locks, sprinklers). The Food Processing Industry acts as a major catalyst, consuming vast quantities of value-added spice blends (masalas) for ready-to-eat meals, snacks, and convenience foods. Furthermore, the rising global popularity of Indian cuisine and the perceived immunity-boosting properties of spices like Turmeric and Ginger are sustaining both domestic consumption and export demand.

Top Emerging Trends in the India Spices Market:

- Shift to Blended Spices: Increasing preference for convenience is driving the demand for application-specific blends like Pav Bhaji Masala, Chicken Masala, and Sabzi Masala, reducing cooking time for working professionals.

- Organic and Clean Label: A growing segment of health-conscious consumers is demanding organic, pesticide-free spices with transparent farm-to-fork traceability.

- Innovative Packaging: Brands are introducing tamper-proof packets, glass jars with grinders, and single-use sachets to maintain freshness and cater to diverse economic segments.

- Medicinal & Nutraceutical Use: The utilization of spice extracts (oleoresins) in the pharmaceutical and nutraceutical sectors is expanding due to their anti-inflammatory and antioxidant properties.

- Agri-Tech Adoption: Farmers are increasingly adopting Plant Growth-Promoting Rhizobacteria (PGPR) and other bio-technologies to enhance seed germination, yield, and shelf life of spice crops.

India Spices Market Growth Factors (Drivers)

- Government Support: Initiatives by the Spices Board of India, such as the establishment of Spices Parks and testing labs, are enhancing export quality and production efficiency.

- Changing Lifestyles: Hectic schedules and dual-income households are fueling the demand for ready-to-use spice mixes that simplify traditional cooking.

- F&B Industry Expansion: The booming restaurant and cafe culture, along with the processed food sector, ensures a steady B2B demand for high-quality bulk spices.

- Health Awareness: The post-pandemic focus on immunity has solidified the status of spices like turmeric, cloves, and cinnamon as essential pantry items.

- Export Potential: India remains the “Spice Bowl of the World,” with consistent international demand for high-grade chilli, cumin, and herbal spices.

Market Segmentation

Analysis by Product Type:

- Pure Spices (Chilli, Turmeric, Coriander, Cumin, Pepper, etc. – Largest market share)

- Blended Spices (Garam Masala, Non-Veg Masala, Kitchen King, etc. – Fastest growing segment)

Analysis by Application:

- Veg Curries (Dominant application in daily Indian diet)

- Meat and Poultry Products

- Snacks and Convenience Foods

- Bakery and Confectionery

- Beverages

- Others

Analysis by Form:

- Packets (Dominant due to convenience and affordability)

- Sprinkler

- Crusher

Regional Insights:

- South India (Production hub for tropical spices)

- North India (High consumption of blended masalas)

- West and Central India

- East India

India Spices Market Recent Developments & News

- Corporate Consolidation: Large FMCG conglomerates like ITC and Tata Consumer Products are aggressively expanding their spice portfolios, often acquiring regional players (e.g., ITC acquiring Sunrise Foods) to consolidate market share.

- Export Standards: Stricter quality checks and the implementation of blockchain for traceability are being adopted to meet the rigorous safety standards of European and American markets.

- Capacity Expansion: Leading brands like Everest and MDH are investing in automated processing plants to meet the surging domestic and international demand.

Why Buy This Report? (High-Value Insights)

- Granular Segmentation: Detailed analysis of Pure vs. Blended spice profitability, helping manufacturers adjust their product mix for higher margins.

- Regional Hotspots: In-depth breakdown of demand in South vs. North India, identifying specific flavor preferences for targeted marketing.

- Future-Ready Trends: Insights into the commercial viability of Cryogenic Grinding Technology, which retains flavor volatiles better than traditional grinding.

Key Highlights of the Report

- Market Forecast (2026-2034): Quantitative data on market value (INR Crores) and high-growth trajectory.

- Competitive Landscape: Comprehensive analysis of national giants versus strong regional challengers.

- Strategic Analysis: Porter’s Five Forces analysis and value chain assessment.

- Technological Trends: Insights into advancements in sterilization and packaging technology.

Customization Note: If you require specific data we can provide it as part of our customization services.