Source: IMARC Group | Category: Chemical & Materials | Author Name: Abhishek Rastogi

Report Introduction

According to IMARC Group’s latest report titled “India E-Waste Recycling Market Size, Share, Trends and Forecast by Material, Source, and Region, 2025-2033”, this study offers a granular analysis of the industry’s shift towards circular economy models and the formalization of waste management. The study offers a profound analysis of the industry, encompassing india electronic waste recycling market size, share, growth factors, key trends, and regional insights. The report covers critical market dynamics, including the impact of the Extended Producer Responsibility (EPR) mandates, the rise of urban mining, and the growing adoption of automated recycling technologies to recover precious metals.

Market At-A-Glance: Key Statistics (2025-2033):

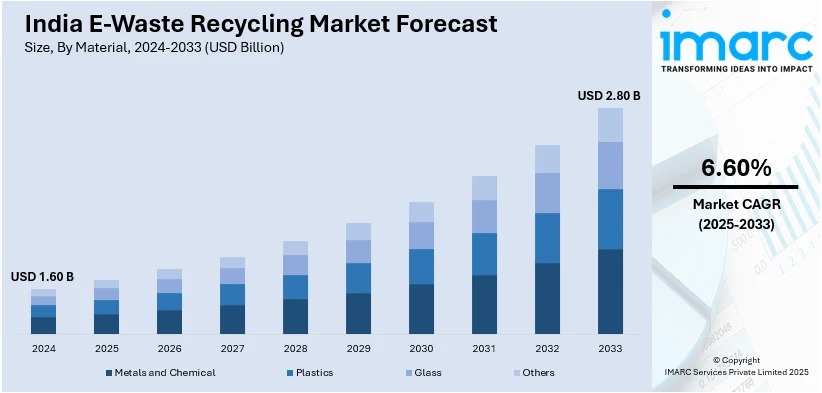

- Current Market Size (2024): USD 1.60 Billion

- Projected Market Size (2033): USD 2.80 Billion

- Growth Rate (CAGR): 6.60%

- Dominant Region: North India (Driven by high e-waste generation in Delhi-NCR and regulatory enforcement)

Note: We are in the process of updating our reports to cover the 2026–2034 forecast period. For the most recent data, market insights, and industry updates, please click on ‘Request Free Sample Report’.

Request Free Sample Report (Exclusive Offer on Corporate Email): https://www.imarcgroup.com/india-e-waste-recycling-market/requestsample

India E-Waste Recycling Market Overview

The India e-waste recycling market size reached USD 1.60 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.80 Billion by 2033, exhibiting a steady growth rate (CAGR) of 6.60% during 2025-2033.

The market is witnessing a structural shift, primarily driven by the exponential increase in electronic consumption and the rapid obsolescence of gadgets like smartphones and laptops. With over 820 million internet users, India generates massive volumes of e-waste, necessitating robust recycling infrastructure. Government intervention through the E-Waste (Management) Rules has been pivotal, enforcing strict EPR targets for manufacturers and incentivizing the formalization of the sector. This has led to the emergence of registered recyclers (322 as of Feb 2025) and refurbishers who use eco-friendly technologies to extract valuable metals like gold, copper, and palladium. Furthermore, there is a growing trend of consumer participation in take-back programs and the rise of digital platforms connecting waste generators with certified recyclers.

Top Emerging Trends in the India E-Waste Recycling Market:

- Stringent Government Regulations: The rigorous implementation of E-Waste Management Rules and Extended Producer Responsibility (EPR) is compelling manufacturers to establish effective collection mechanisms and partner with authorized recyclers.

- Shift to Formal Recycling: There is a notable transition from the informal sector to formal, organized recycling facilities that utilize advanced technologies for safe disassembly and efficient recovery of precious metals like gold and palladium.

- Integration of Digital Platforms: Companies are increasingly launching mobile apps and online platforms to facilitate convenient doorstep e-waste collection, offering transparency and incentives to consumers for responsible disposal.

- Rising Consumer Awareness: Targeted awareness campaigns by the government and non-profits are successfully educating consumers about the environmental hazards of e-waste, driving the use of authorized collection centers.

- Focus on Urban Mining: The concept of “urban mining”—recovering valuable materials from discarded electronics rather than mining virgin ores—is gaining traction as a sustainable and economically viable practice.

India E-Waste Recycling Market Growth Factors (Drivers)

- Surging Electronic Consumption: Rapid economic growth, urbanization, and the digitization of services have led to an explosive demand for consumer electronics, directly increasing the volume of e-waste generated.

- Shortened Product Lifecycles: Rapid technological advancements and the consumer desire for the latest gadgets result in frequent upgrades and early obsolescence, creating a continuous stream of waste.

- Expanding Digital User Base: With over 820 million internet users, including a significant rural population, the penetration of electronic devices has widened substantially, expanding the overall market for recycling.

- Corporate Sustainability Initiatives: A growing focus on ESG (Environmental, Social, and Governance) goals is driving corporations to ensure their e-waste is processed responsibly, boosting demand for certified recycling services.

- Infrastructure Development: Government incentives and subsidies for setting up recycling plants are encouraging private investment and improving the country’s e-waste processing capacity.

Market Segmentation

Analysis by Material:

- Metals and Chemicals (Dominant segment due to high economic value of recovered gold, copper, etc.)

- Plastics

- Glass

- Others

Analysis by Source:

- Consumer Electronics (Major contributor due to short replacement cycles of mobiles/laptops)

- Household Appliances (Refrigerators, ACs)

- IT and Telecommunication

- Medical Equipment

- Others

Regional Insights:

- North India: Leading region due to high consumption and established recycling hubs in Delhi-NCR.

- South India

- West India

- East India

India E-Waste Recycling Market Recent Developments & News

- February 2025: CPCB registered 322 recyclers and 72 refurbishers, indicating a strengthening formal ecosystem.

- July 2024: Attero launched “Selsmart,” a consumer-facing platform for doorstep e-waste collection, enhancing last-mile connectivity.

- October 2023: Launch of “Recycling on Wheels Smart-ER” to promote mobile e-waste collection and awareness.

Why Buy This Report? (High-Value Insights)

- Granular Segmentation: Detailed analysis of Material vs. Source revenue streams, helping recyclers optimize extraction processes.

- Regional Hotspots: In-depth breakdown of e-waste generation in Delhi vs. Bangalore, aiding in facility location planning.

- Future-Ready Trends: Insights into the recycling of Li-ion batteries, highlighting the next big opportunity in the EV era.

Key Highlights of the Report

- Market Forecast (2025-2033): Quantitative data on market value and growth trajectory.

- Competitive Landscape: Comprehensive analysis of key market players and their processing capacities.

- Strategic Analysis: Porter’s Five Forces analysis and value chain assessment.

- Technological Trends: Insights into advancements in hydrometallurgical extraction techniques.

Customization Note: If you require specific data we can provide it as part of our customization services.