Source: IMARC Group | Category: Food & Beverages | Author Name: Abhishek Rastogi

Report Introduction

According to IMARC Group’s latest report titled “Dairy Industry in India 2026 Edition: Market Size, Growth, Prices, Segments, Cooperatives, Private Dairies, Procurement and Distribution”, this study offers a granular analysis of the country’s transformation from a milk-deficient nation to the world’s largest milk producer. The study offers a profound analysis of India dairy market size, encompassing market share, growth factors, key trends, and regional insights. The report covers critical market dynamics, including the rise of B2C dairy startups, the increasing consumption of value-added products like cheese and probiotic drinks, and the modernization of cold chain infrastructure supported by government initiatives.

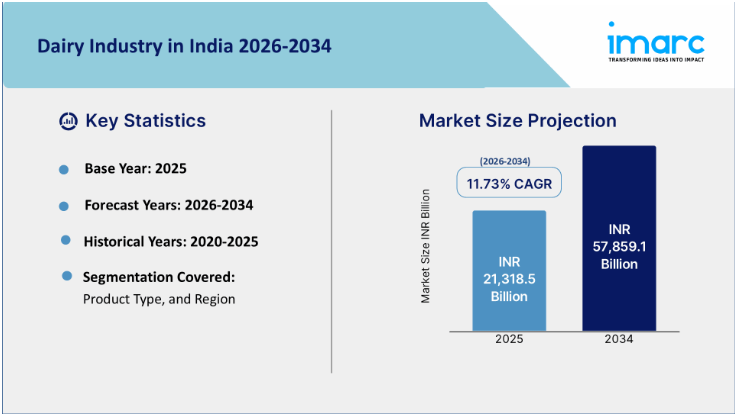

Market At-A-Glance: Key Statistics (2026-2034):

- Current Market Size (2025): INR 21,318.5 Billion

- Projected Market Size (2034): INR 57,859.1 Billion

- Growth Rate (CAGR): 11.73%

- Dominant Region: Uttar Pradesh (Holding ~18.7% market share due to its massive agrarian economy and livestock population)

- Leading Key Players: Amul (GCMMF), Mother Dairy, Nestle, Britannia, Hatsun Agro Product (HAP), and Parag Milk Foods.

Request Free Sample Report (Exclusive Offer on Corporate Email): https://www.imarcgroup.com/dairy-industry-in-india/requestsample

Dairy Industry in India Overview

The dairy industry in India size reached INR 21,318.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach INR 57,859.1 Billion by 2034, exhibiting a robust double-digit growth rate (CAGR) of 11.73% during 2026-2034.

The industry is witnessing a structural shift, primarily driven by the transition from unorganized to organized retail. While liquid milk remains the cornerstone, accounting for over 65% of the market, there is an aggressive push towards value-added dairy products (VADP). Changing consumer lifestyles and rising disposable incomes are fueling the demand for convenient, protein-rich options like flavored milk, yogurt, and cheese. Technological advancements, such as IoT-enabled farm management and automated milking systems, are enhancing productivity and milk quality. Furthermore, the proliferation of online grocery platforms and subscription-based delivery models is reshaping the distribution landscape, ensuring fresher products reach urban consumers directly.

Top Emerging Trends

- Shift to Value-Added Products: There is a significant consumer shift from traditional liquid milk to value-added products like cheese, yogurt, probiotic drinks, and flavored milk, driven by the desire for convenience and variety.

- Rise of Organic and A2 Milk: Growing health consciousness is fueling the demand for organic and A2 milk varieties, which are perceived as healthier, chemical-free, and more nutritious alternatives to conventional options.

- Digital Transformation in Distribution: The emergence of D2C (Direct-to-Consumer) startups and subscription-based delivery models is revolutionizing the supply chain, ensuring fresh delivery and catering to the convenience sought by urban consumers.

- Adoption of Smart Dairy Farming: Farmers and cooperatives are increasingly adopting automation, IoT-based monitoring, and advanced breeding technologies to enhance milk yield, animal health, and overall production efficiency.

- Focus on Sustainable Packaging: To address environmental concerns, companies are innovating with eco-friendly packaging solutions, such as glass bottles and biodegradable materials, for premium dairy products.

Growth Factors (Drivers)

- Rising Income and Urbanization: The expanding middle class and rapid urbanization are increasing disposable incomes, leading to higher expenditure on diverse and premium dairy products beyond basic necessities.

- Government Initiatives: Schemes like the National Programme for Dairy Development and the Rashtriya Gokul Mission are actively supporting infrastructure development, veterinary care, and breeding, thereby boosting milk productivity.

- Health and Wellness Awareness: The escalating preference for protein-rich diets and immunity-boosting foods post-pandemic is driving the consumption of fortified and functional dairy products.

- Improved Cold Chain Infrastructure: Significant investments in cold storage and refrigerated transport are reducing spoilage, extending shelf life, and allowing producers to reach wider, distant markets effectively.

- Expansion of Organized Retail: The growth of modern retail formats, including supermarkets and hypermarkets, along with booming e-commerce platforms, is improving product accessibility and visibility for consumers across the country.

Market Segmentation

Analysis by Product Type:

- Liquid Milk (Dominant segment; essential staple)

- A2 Milk (Fastest growing niche)

- UHT Milk

- Organic Milk

- Flavored Milk & Yoghurts

- Cheese & Butter

- Ghee (Traditional staple with high value)

- Ice Cream

- Dairy Sweets

- Others (Paneer, Khoya, Skimmed Milk Powder)

Regional Insights:

- Uttar Pradesh: The largest market, supported by a vast network of cooperatives and high buffalo population.

- Rajasthan & Gujarat: Key milk-surplus states with strong cooperative structures (e.g., Amul in Gujarat).

- Delhi-NCR: Rapidly growing urban market driving demand for premium and packaged dairy.

- Maharashtra

- Karnataka

- Tamil Nadu

- Others

Dairy Industry in India Recent Developments & News

- January 2025: Hatsun Agro Product (HAP) acquired Milk Mantra Dairy for ₹233 crore to strengthen its foothold in Eastern India.

- November 2024: Nandini Dairy entered the Delhi-NCR market, challenging incumbents with competitive pricing.

- October 2024: Britannia Bel Foods inaugurated a ₹220 crore cheese plant in Pune to produce “The Laughing Cow” products locally.

- May 2024: Amul announced the launch of high-protein “super milk” to cater to the fitness-conscious demographic.

Why Buy This Report? (High-Value Insights)

- Granular Segmentation: Detailed analysis of Liquid Milk vs. Value-Added revenue streams, helping businesses identify high-margin opportunities.

- Regional Hotspots: In-depth breakdown of demand in Uttar Pradesh vs. South India, assisting in procurement and distribution planning.

- Future-Ready Trends: Insights into the commercial viability of Camel Milk and Lactose-Free products, highlighting niche growth areas.

Key Highlights of the Report

- Market Forecast (2026-2034): Quantitative data on market value and rapid growth trajectory.

- Competitive Landscape: Comprehensive analysis of key cooperatives (Amul, Mother Dairy) vs. private players (Nestle, Britannia).

- Strategic Analysis: Porter’s Five Forces analysis and value chain assessment.

- Technological Trends: Insights into advancements in blockchain for supply chain traceability.

Customization Note: If you require specific data we can provide it as part of our customization services.