Summary:

- The global mining waste management market size reached USD 209.5 Billion in 2023.

- The market is expected to reach USD 308.9 Billion by 2032, exhibiting a growth rate (CAGR) of 4.3% during 2024-2032.

- Region-wise, the market has been classified into North America (the United States and Canada), Asia Pacific (China, Japana, India, South Korea, Australia, Indonesia, and others), Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others), Latin America (Brazil, Mexico, and others), and Middle East and Africa.

- Based on the mining type, the market has been divided into surface and underground.

- On the basis of the mineral/metal, the market has been segmented into coal, iron, gold, aluminium, copper, nickel, and others.

- Based on the waste type, the market has been segregated into waste rock, tailings, mine water, and others.

- The expansion of mining activities in emerging markets is a primary driver of the mining waste management market.

- Increased focus on mine rehabilitation, along with the rising costs of waste disposal are reshaping the mining waste management market.

Industry Trends and Drivers:

- Stringent environmental regulations:

Increasingly stringent environmental regulations imposed by governments and international bodies are one of the primary drivers of the global mining waste management market. Mining operations generate significant volumes of waste, including tailings, overburden, and slag, which can pose substantial environmental risks if not managed properly. In response, regulatory bodies have implemented laws that require mining companies to adopt sustainable waste management practices. For instance, regulations in the U.S. by the Environmental Protection Agency (EPA) or in the European Union, such as the EU’s Mining Waste Directive, mandate strict controls on how mining waste is stored, treated, and disposed of. Failure to comply with these regulations can result in severe financial penalties, shutdowns, or loss of operational licenses, forcing companies to invest in better waste management systems.

- Growing awareness about corporate social responsibility (CSR) and sustainability initiatives:

Corporate social responsibility (CSR) and sustainability have become central to the operations of mining companies globally. Mining companies are under increasing scrutiny from both the public and investors, who are prioritizing environmentally and socially responsible practices. Sustainable mining has become a significant part of corporate agendas, aiming to minimize ecological damage and reduce the social impacts of mining activities. Mining waste management plays a crucial role in these sustainability efforts. As public awareness about environmental issues grows, stakeholders, including investors, local communities, and consumers, demand more transparent and sustainable practices. This has led to mining companies adopting better waste management strategies that reduce their ecological footprint. For instance, the concept of a “circular economy” has gained traction in mining waste management, where waste materials are treated and reused instead of being disposed of. Moreover, several mining companies now voluntarily adhere to international sustainability frameworks such as the Global Reporting Initiative (GRI) and the International Council on Mining and Metals (ICMM), which set standards for responsible environmental practices, including waste management.

- Technological advancements in waste management solutions:

Technological innovation is another critical driver of the global mining waste management market. Advanced technologies are revolutionizing how mining waste is processed, stored, and managed, helping companies comply with environmental regulations and sustainability goals more efficiently. One such innovation is the development of automated and digitized waste management systems, which allow for better tracking, monitoring, and optimization of waste disposal. The use of drones, for instance, has improved the ability to monitor vast mining sites, offering real-time data on waste volumes and potential environmental risks. Similarly, artificial intelligence (AI) and machine learning are being used to predict waste generation and identify the most efficient disposal or treatment methods. These technologies also enable companies to automate waste management processes, reducing human error and lowering operational costs.

Request Sample For PDF Report: https://www.imarcgroup.com/mining-waste-management-market/requestsample

Report Segmentation:

The report has segmented the market into the following categories:

Breakup by Mining Type:

- Surface

- Underground

Based on the mining type, the market has been divided into surface and underground.

Breakup by Mineral/Metal:

- Coal

- Iron

- Gold

- Aluminium

- Copper

- Nickel

- Others

On the basis of the mineral/material, the market has been segmented into coal, iron, gold, aluminium, copper, nickel, and others.

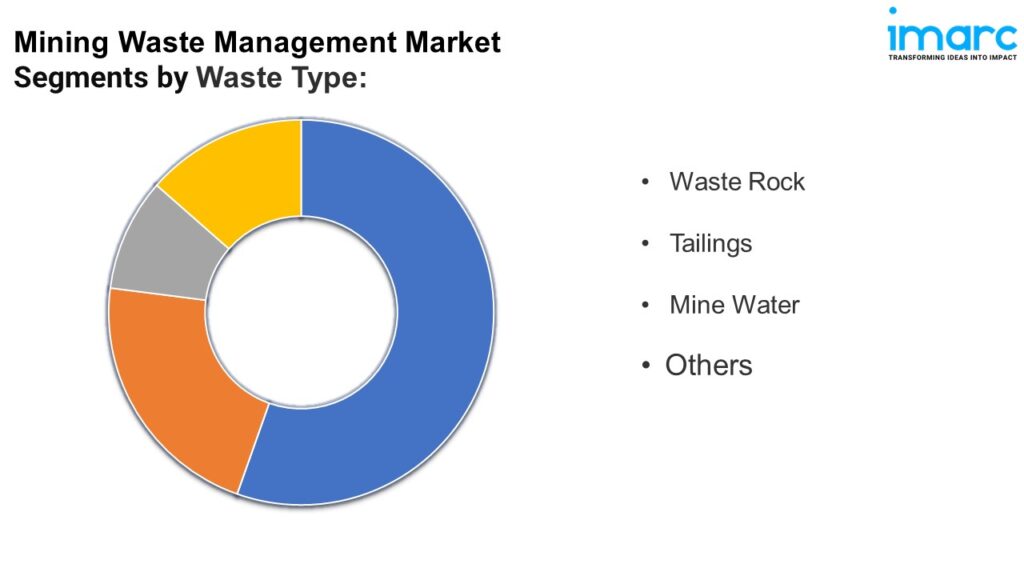

Breakup by Waste Type:

- Waste Rock

- Tailings

- Mine Water

- Others

Based on the waste type, the market has been segregated into waste rock, tailings, mine water, and others.

Market Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Region-wise, the market has been classified into North America (the United States and Canada), Asia Pacific (China, Japana, India, South Korea, Australia, Indonesia, and others), Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others), Latin America (Brazil, Mexico, and others), and Middle East and Africa.

Top Mining Waste Management Market Leaders:

- AMEC Foster Wheeler Plc (John Wood Group Plc)

- Ausenco Limited

- Enviropacific Services Limited

- EnviroServ Waste Management Ltd.

- Golder Associates Inc. (Enterra Holdings Ltd.)

- Hatch Ltd.

- Interwaste Holdings Limited (Séché South Africa Proprietary Limited)

- Teck Resources Limited

- Tetra Tech Inc.

- Veolia Environnement S.A.

- Ramboll Group A/S.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.