Global Cocoa Processing Industry: Key Statistics and Insights in 2024-2032

Summary:

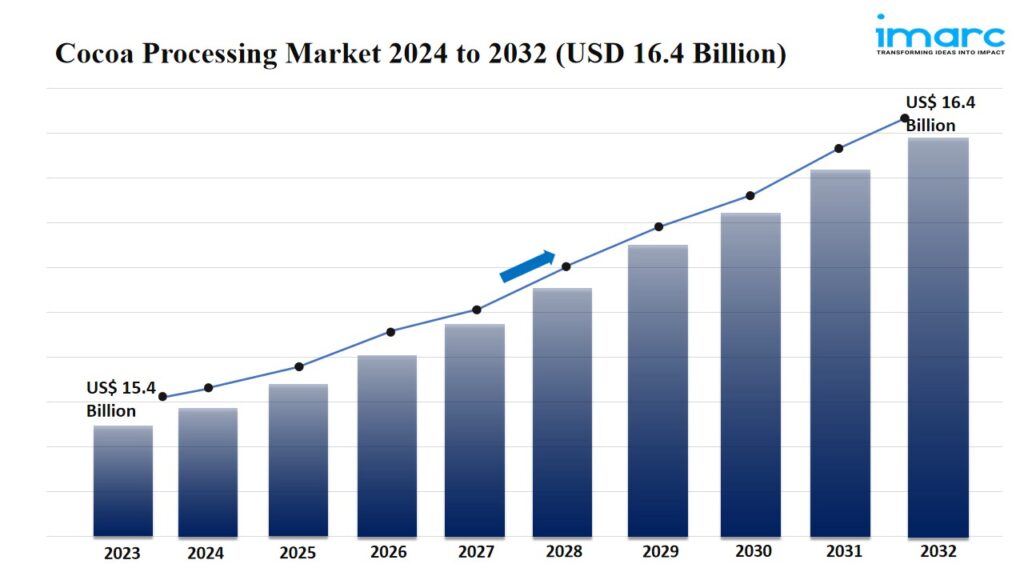

- The global cocoa processing market size reached USD 15.4 Billion in 2023.

- The market is expected to reach USD 16.4 Billion by 2032.

- Europe leads the market, accounting for the largest cocoa processing market share.

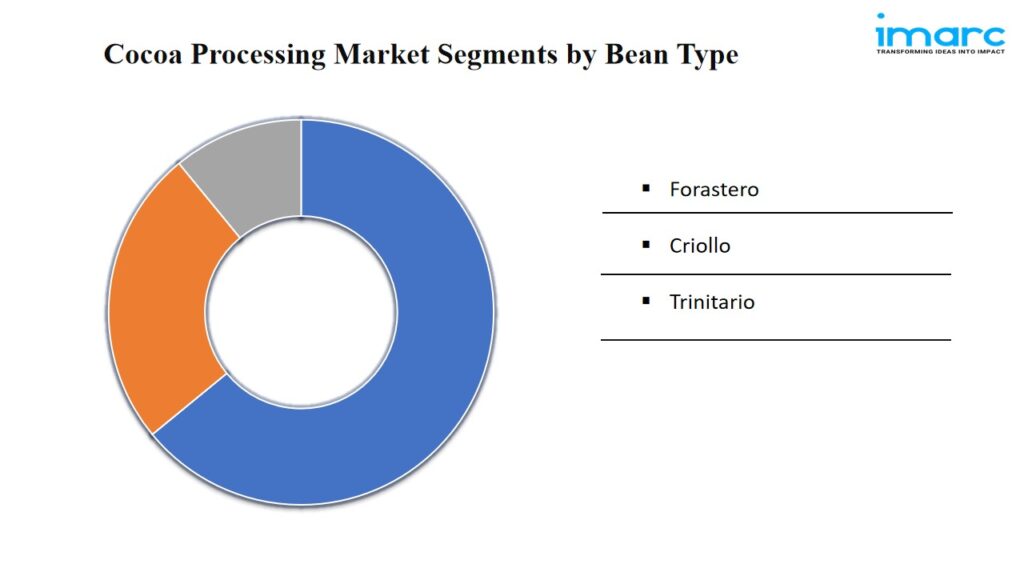

- Forastero accounts for the majority of the market share in the bean type segment due to its robustness, higher yield, and less complex flavor profile.

- Cocoa liquor holds the largest share in the cocoa processing industry.

- Confectionary remain a dominant segment in the market, driven by the growing demand for chocolate and other cocoa-based sweets among the masses.

- The rising focus on sustainability and ethical sourcing is a primary driver of the cocoa processing market.

- Technological advancements in processing and the increasing use of cocoa in the cosmetic industry are reshaping the cocoa processing market.

Industry Trends and Drivers:

- Increasing use of cocoa in the cosmetic industry:

Cocoa butter, a key by-product of cocoa processing, is highly valued in the cosmetics industry for its moisturizing properties. It is widely used in products like lotions, creams, and lip balms. The natural antioxidant content in cocoa also makes it an attractive ingredient for anti-aging and skin protection products. Individuals are continuously seeking natural and organic beauty products, which is driving the demand for cocoa-based cosmetics. This trend is particularly strong in markets where individuals are rejecting synthetic ingredients in favor of natural alternatives. Cocoa processors are capitalizing on this demand by supplying high-quality cocoa butter and other derivatives to the cosmetics industry.

- Rising focus on sustainability and ethical sourcing:

Consumers are increasingly aware about the environmental and social impacts of cocoa cultivation, driving the demand for sustainably sourced cocoa products. This shift is encouraging processors and chocolate manufacturers to adopt practices that ensure environmental stewardship, social responsibility, and economic viability for farmers. Certifications are becoming more prevalent, assuring consumers of the ethical origins of their cocoa. This trend is reinforcing the integrity of the supply chain, from farmers to end consumers, and is fostering a more sustainable cocoa economy. Moreover, sustainable practices in cocoa processing are attracting investment and consumer loyalty and encouraging the adoption of more responsible and transparent supply chains.

- Technological advancements in processing:

Modern processing technologies are enabling producers to maximize yield and optimize the extraction of cocoa butter and powder, which are essential ingredients in various food and cosmetic products. Innovations in fermentation methods, drying techniques, and roasting processes are improving the flavor profiles and quality of cocoa, meeting the stringent quality standards imposed on the industry. Additionally, automation and digitization in processing facilities are streamlining operations, reducing labor costs, and increasing production scalability. These technological enhancements are not only improving product quality and operational efficiency but also enabling producers to respond swiftly to the changing demands and preferences of the market, thereby securing a competitive edge.

Request PDF Sample for more detailed market insights: https://www.imarcgroup.com/cocoa-processing-plant/requestsample

Cocoa Processing Market Report Segmentation:

Breakup By Bean Type:

- Forastero

- Criollo

- Trinitario

Forastero exhibits a clear dominance in the market due to its robustness, higher yield, and less complex flavor profile, making it preferred by large-scale chocolate manufacturers for mass production.

Breakup By Product Type:

- Cocoa Butter

- Cocoa Liquor

- Cocoa Powder

Cocoa liquor represents the largest segment attributed to its crucial role in chocolate making, providing the base from which various types of chocolate and cocoa products are produced.

Breakup By Application:

- Confectionary

- Bakery

- Beverages

- Pharmaceuticals

- Others

Confectionary holds the biggest market share accredited to the growing demand for chocolate and other cocoa-based sweets among the masses.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Europe dominates the market owing to its long-established chocolate industry, high per capita consumption of chocolate, and presence of major chocolate manufacturers and confectionery brands.

Top Cocoa Processing Market Leaders:

The cocoa processing market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- Guan Chong Bhd

- Ecom Agroindustrial Corp. Limited

- Nestlé SA

- Barry Callebaut Group

- Blommer Chocolate Company

- Mondelez International, Inc.

- Cargill Incorporated

- Olam International

- Touton S.A.

Note: If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145