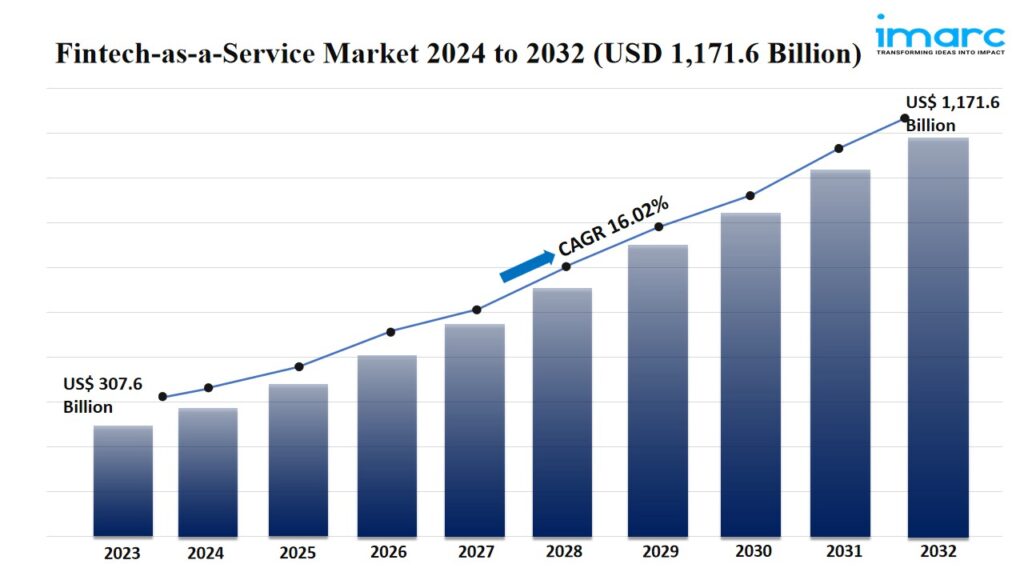

IMARC Group’s report titled “Fintech-as-a-Service Market Report by Type (Payment, Fund Transfer, Loan, and Others), Technology (API, Artificial Intelligence, RPA, Blockchain, and Others), Application (KYC Verification, Fraud Monitoring, Compliance and Regulatory Support, and Others), End Use (Banks, Financial Lending Companies, Insurance, and Others), and Region 2024-2032“. The global fintech-as-a-service market size reached US$ 307.6 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 1,171.6 Billion by 2032, exhibiting a growth rate (CAGR) of 16.02% during 2024-2032.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/fintech-as-a-service-market/requestsample

Factors Affecting the Growth of the Fintech-as-a-Service Industry:

- Technological Advancements:

Artificial intelligence (AI) and machine learning (ML) are at the forefront of transforming FaaS offerings by enabling more personalized user experiences, improving risk management, and automating complex processes like underwriting and fraud detection. These technologies help in analyzing vast amounts of data to derive insights, predict customer behavior, and provide tailored financial advice. Blockchain offers a highly secure and transparent way to record transactions. In the FaaS sector, it facilitates faster payments, enhances security, and reduces fraud. The ability of the blockchain to provide decentralized finance (DeFi) services is also pivotal, allowing companies to offer services like smart contracts, real-time cross-border payments, and transparent auditing processes.

- Increasing Demand for Digital Financial Services:

Modern people are expecting quick, convenient, and user-friendly financial services. The rise of mobile banking, contactless payments, and digital wallets demonstrates a shift towards digital-first financial interactions. FaaS platforms cater to these expectations by integrating such services seamlessly into various applications. Businesses are looking for efficient ways to manage financial transactions, reduce costs, and improve user experiences. FaaS solutions offer companies the tools to automate payments, invoicing, and other financial processes, thereby streamlining operations and enhancing scalability.

- Cost Efficiency:

Developing in-house financial solutions can be expensive and time-consuming, involving significant investments in technology, infrastructure, and specialized personnel. FaaS platforms provide ready-to-use financial services that businesses can integrate quickly and at a fraction of the cost of building these systems from scratch. FaaS solutions automate many aspects of financial operations, such as payments processing, fraud detection, and compliance monitoring. This automation reduces the need for manual intervention, thereby cutting down on labor costs and minimizing errors.

Leading Companies Operating in the Global Fintech-as-a-Service Industry:

- Block Inc.

- FIS, Inc.

- Fiserv, Inc.

- Mastercard Inc.

- PayPal Holdings, Inc.

- Railsbank Technology Limited

- Rapyd Financial Network Ltd.

- Solid Financial Technologies, Inc.

- Synctera Inc.

Fintech-as-a-Service Market Report Segmentation:

By Type:

- Payment

- Fund Transfer

- Loan

- Others

Payment represents the largest segment due to the widespread adoption of digital transactions and the need for seamless, secure payment solutions across industries.

By Technology:

- API

- Artificial Intelligence

- RPA

- Blockchain

- Others

Blockchain accounts for the majority of the market share owing to its ability to offer secure, transparent, and efficient transaction solutions, which are critical in building trust and compliance in financial services.

By Application:

- KYC Verification

- Fraud Monitoring

- Compliance and Regulatory Support

- Others

Compliance and regulatory support exhibit a clear dominance as financial institutions increasingly rely on FaaS solutions to navigate complex, evolving regulatory environments efficiently and cost-effectively.

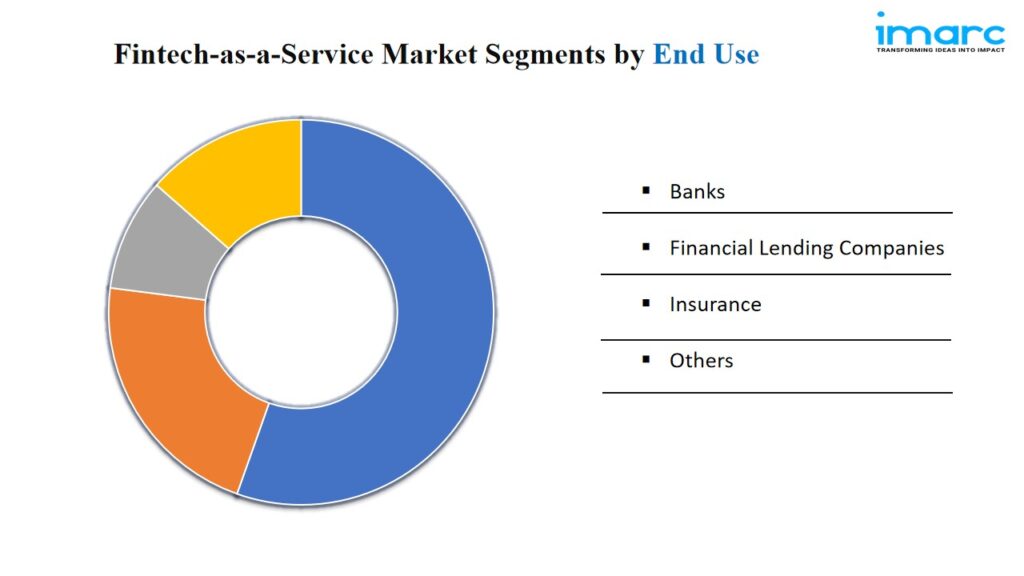

By End Use:

- Banks

- Financial Lending Companies

- Insurance

- Others

Insurance holds the biggest market share driven by the integration of FaaS solutions in the insurance sector to streamline claims processing, fraud detection, and customer relationship management, driving significant market share.

Regional Insights:

- North America: (United States, Canada)

- Asia Pacific: (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe: (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America: (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position in the fintech-as-a-service market on account of its advanced financial infrastructure, high technology adoption rates, and robust regulatory frameworks that support fintech innovations.

Global Fintech-as-a-Service Market Trends:

Beyond cryptocurrency transactions, blockchain technology is used for its security features in contract management, identity verification, and compliance adherence, promoting transparency and trust. The demand for digital payment solutions is rising, driven by consumer preferences for quick and easy transactions. This is leading to broader adoption of FaaS payment solutions across various sectors.

FaaS is playing a crucial role in enhancing financial inclusion by providing underserved and unbanked populations access to basic financial services through mobile and cloud-based technologies. With the rise in digital financial services, there is an increasing focus on cybersecurity. FaaS providers are investing in advanced security protocols to protect sensitive financial data and build user trust.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARCs information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the companys expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145