Vietnam Construction Market Overview

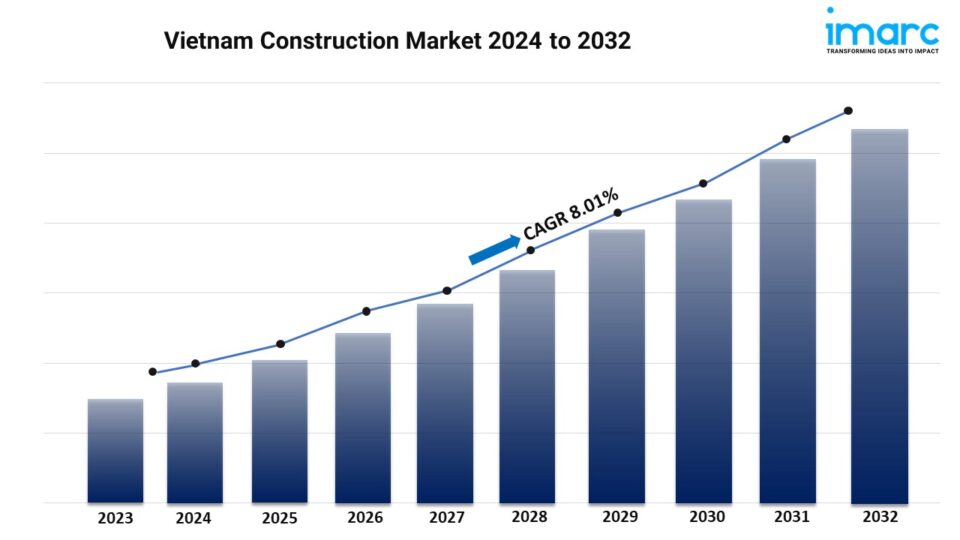

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 8.01% (2024-2032)

The Vietnam construction market is booming with increased infrastructure projects and urban development driving strong demand. According to the latest report by IMARC Group, the market is projected to grow at a CAGR of 8.01% from 2024 to 2032.

Vietnam Construction Market Trends and Drivers:

The Vietnamese construction market is being propelled by a convergence of several key factors that underscore the economic development and urban expansion of the country. The robust economic growth of Vietnam, marked by a steady GDP increase and rising foreign direct investment (FDI), has laid a solid foundation for the construction industry. The government has actively promoted policies to attract foreign investors, especially in infrastructure, real estate, and industrial construction, creating a thriving investment climate.

Additionally, the urbanization rate in Vietnam has been accelerating, with a growing population moving from rural areas to urban centers. This rapid urbanization has necessitated the development of residential, commercial, and infrastructural projects, such as housing, roads, and public transport systems, to meet the demands of a burgeoning urban population.

Moreover, the ambitious public infrastructure development plans of the country further fuel the construction sector. The government has allocated substantial funds to large-scale infrastructure projects, including the construction of expressways, bridges, ports, and airports, to enhance connectivity and reduce logistical costs. The “National Urban Development Program” and the “Socio-Economic Development Strategy 2021-2030” underscore the commitment of Vietnam to developing smart and sustainable cities, integrating modern urban planning principles with green building practices.

Technological advancements and the adoption of sustainable building practices, such as the use of green materials and energy-efficient designs, also play a significant role in driving growth. Furthermore, the integration of this nation into global trade networks through free trade agreements (FTAs) such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the EU-Vietnam Free Trade Agreement (EVFTA) enhances its appeal as a manufacturing hub, spurring the demand for industrial and logistics facilities. Another critical factor is the increasing demand for quality housing driven by rising disposable incomes and a growing middle class. As the purchasing power of the citizens of Vietnam improves, there is a notable shift toward modern, well-designed residential properties. This demand is further amplified by changing lifestyle preferences, with many seeking properties that offer better amenities and higher living standards.

Vietnam Construction Market Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Vietnam Construction Market Share. It includes forecasts for 2024-2032 and historical data from 2018-2023 for the following segments.

The report has segmented the market into the following categories:

Sector Insights:

- Residential Construction

- Commercial Construction

- Industrial Construction

- Infrastructure (Transportation) Construction

- Energy and Utilities Construction

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

For an in-depth analysis, you can refer to a sample copy of the report:

https://www.imarcgroup.com/vietnam-construction-market/requestsample

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current, and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARCs information products include major market, scientific, economic, and technological developments for business leaders in pharmaceutical, industrial, and high-technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology, and novel processing methods are at the top of the company’s expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145