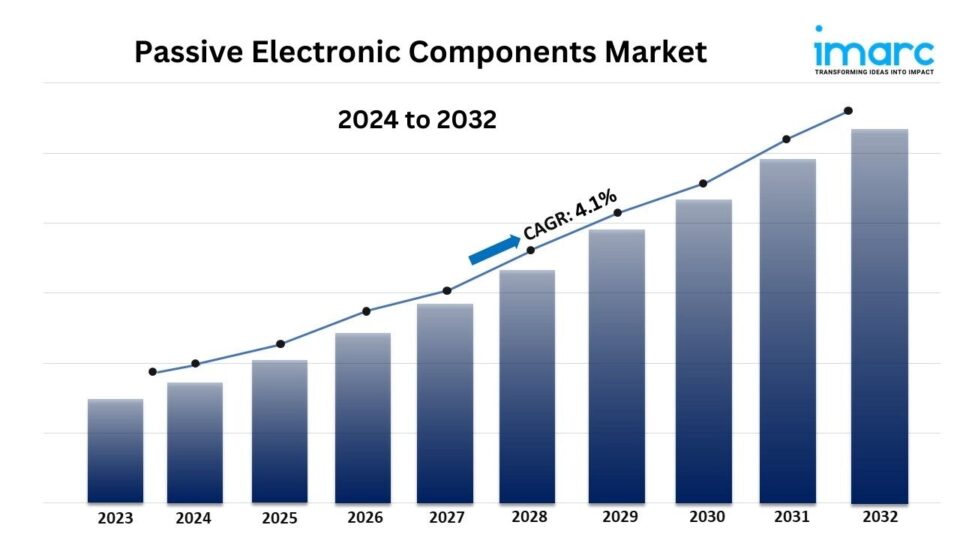

The latest report by IMARC Group, titled” Passive Electronic Components Market Report by Type (Capacitor, Inductor, Resistor), End Use Industry (Aerospace and Defense, Consumer Electronics, Information Technology, Automotive, Industrial, and Others), and Region 2024-2032“, offers a comprehensive analysis of the industry, which comprises insights on the market. The global passive electronic components market size reached US$ 38.3 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 55.6 Billion by 2032, exhibiting a growth rate (CAGR) of 4.1% during 2024-2032.

Factors Affecting the Growth of the Passive Electronic Components Industry:

- Rising Demand in Consumer Electronics and Automotive Sectors:

The growth of the passive electronic components industry is significantly influenced by the rising demand in consumer electronics and automotive sectors. With the proliferation of smartphones, tablets, laptops, and wearable devices, there is an increased need for components such as resistors, capacitors, and inductors that are integral to electronic circuitry. Similarly, the automotive industry is rapidly integrating advanced electronic systems for functions such as infotainment, safety, and autonomous driving, all of which rely on high-performance passive components. As technology evolves and more sophisticated features are added to consumer and automotive electronics, there has been a rise in demand for passive components. The shift toward electric vehicles (EVs) also contributes to this trend, as EVs require a higher volume of electronic components for battery management and power conversion systems, driving further growth in the industry.

- Technological Advancements and Miniaturization:

Technological advancements and the trend toward miniaturization are key factors driving the growth of the passive electronic components industry. As electronic devices become smaller and more compact, there is a need for miniature components that can fit into increasingly limited spaces without compromising performance. Innovations in materials and manufacturing processes have enabled the development of smaller, yet more efficient, passive components that meet these demands. Additionally, advancements in multilayer and thin-film technologies have improved the performance and reliability of passive components, making them more suitable for high-frequency applications and harsh environments. This has opened new opportunities in sectors such as telecommunications and industrial automation, where compact and robust components are essential. As technology continues to advance, the industry is likely to see increased adoption of these miniaturized components across various applications.

- Supply Chain Challenges and Raw Material Costs:

Supply chain challenges and fluctuating raw material costs are significant factors affecting the growth of the passive electronic components industry. The production of passive components relies on materials such as ceramics, tantalum, and nickel, which are subject to price volatility and supply constraints. Disruptions in the supply chain, whether due to geopolitical tensions, natural disasters, or other factors, can lead to shortages and increased costs, impacting the availability and pricing of passive components. Additionally, the industry faces challenges related to the sustainability and ethical sourcing of raw materials, particularly in the case of conflict minerals. Companies must navigate these complexities to maintain steady production and meet demand, which can require strategic sourcing and inventory management practices. Addressing these challenges is crucial for the continued growth and stability of the passive electronic components industry.

For an in-depth analysis, you can request a sample copy of the report: https://www.imarcgroup.com/passive-electronic-components-market/requestsample

Leading Companies Operating in the Global Passive Electronic Components Market

- Eaton Corporation PLC

- KOA Corporation

- Kyocera Corporation

- Murata Manufacturing Co. Ltd.

- Panasonic Corporation

- Samsung Electro-Mechanics Co. Ltd.

- Taiyo Yuden Co. Ltd.

- TDK Corporation

- TE Connectivity

- TT Electronics Plc

- Vishay Intertechnology Inc.

- Yageo Corporation.

Passive Electronic Components Market Report Segmentation:

By Type:

- Capacitor

- Ceramic Capacitors

- Tantalum Capacitors

- Aluminum Electrolytic Capacitors

- Paper and Plastic Film Capacitors

- Supercapacitors

- Inductor

- Power

- Frequency

- Resistor

- Surface-mounted Chips

- Network

- Wirewound

- Film/Oxide/Foil

- Carbon

Capacitors dominate the market due to their essential role in energy storage and power regulation across various electronic devices.

By End Use Industry:

- Aerospace and Defense

- Consumer Electronics

- Information Technology

- Automotive

- Industrial

- Others

Consumer electronics account for the largest market shareas the widespread use of smartphones, laptops, and other digital devices drives substantial demand for passive components.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia-Pacific’s dominance in the passive electronic components market is attributed to its position as a global manufacturing hub for electronics and the presence of key component manufacturers in countries such as China, Japan, and South Korea.

Global Passive Electronic Components Market Trends:

The global passive electronic components market is experiencing robust growth, driven by the increasing adoption of electronic devices across various sectors, including consumer electronics, automotive, telecommunications, and industrial applications. Key trends in the market include the growing demand for miniaturized components due to the push for smaller, more compact devices. Advancements in technology, such as multilayer ceramic capacitors (MLCCs) and high-frequency inductors, are enhancing component performance and reliability, catering to the needs of modern, high-speed electronic systems. Additionally, the rise of electric vehicles (EVs) and renewable energy technologies is creating new opportunities for passive components, particularly in power management and conversion systems. Furthermore, environmental concerns and regulations are also influencing market trends, with manufacturers focusing on developing eco-friendly components that use sustainable materials.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145