Global Commercial Telematics Industry: Key Statistics and Insights in 2024-2032

Summary:

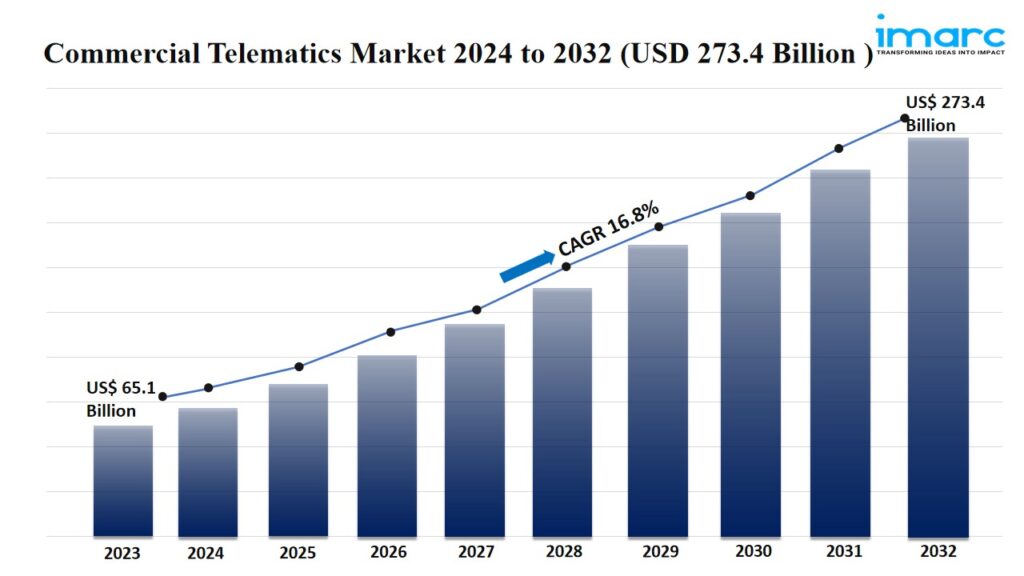

- The global commercial telematics market size reached USD 65.1 Billion in 2023.

- The market is expected to reach USD 273.4 Billion by 2032, exhibiting a growth rate (CAGR) of 16.8% during 2024-2032.

- North America leads the market, accounting for the largest commercial telematics market share.

- Solution (fleet tracking and monitoring, driver management, insurance telematics, safety and compliance, V2X solutions, and others) accounts for the majority of the market share in the type segment.

- Embedded holds the largest share in the commercial telematics industry.

- Aftermarket remain a dominant segment in the market, driven by the flexible and cost-effective telematics solutions that can be retrofitted into existing vehicles.

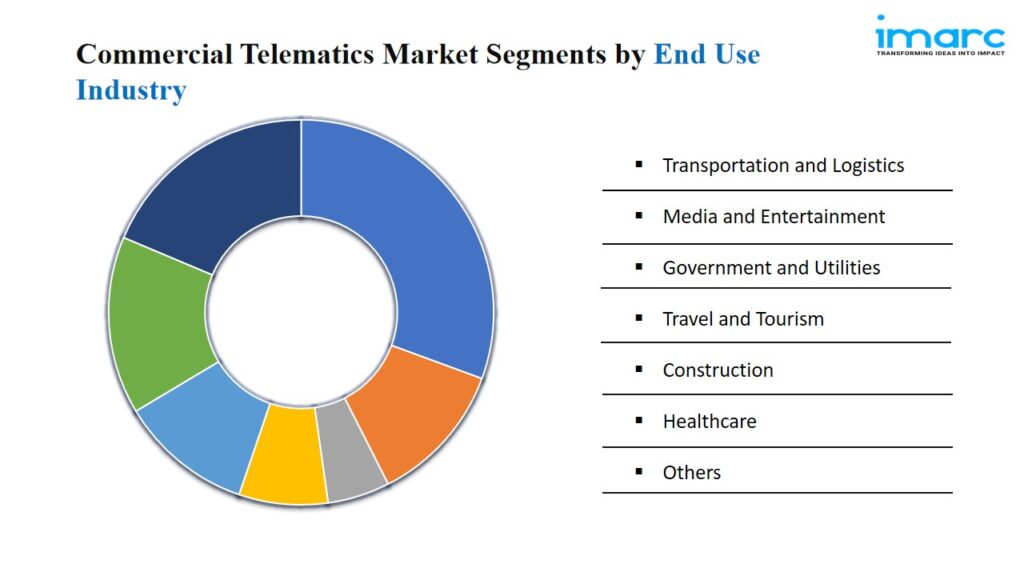

- Transportation and logistics represent the leading end use industry segment.

- The increasing focus on fleet management is a primary driver of the commercial telematics market.

- Advancements in connectivity technology and the growing demand for driver safety solutions are reshaping the commercial telematics market.

Industry Trends and Drivers:

- Advancements in connectivity technology:

The ongoing evolution of connectivity technologies, particularly the deployment of 4G and 5G networks, is offering faster, more reliable data transmission, enabling seamless, real-time communication between vehicles and central management systems. Businesses can collect and analyze vast amounts of data in real-time with high-speed networks, enhancing decision-making processes related to fleet operations, asset tracking, and vehicle performance. The introduction of 5G specifically facilitates the use of advanced telematics applications, such as predictive maintenance, remote diagnostics, and enhanced driver assistance systems, which rely on high bandwidth and low latency. The advancement in connectivity infrastructure is enabling businesses to leverage telematics solutions for smarter, data-driven operations, ultimately leading to lower costs and improved client service.

- Increasing focus on fleet management:

Rising fuel costs, increasing competition, and the demand for higher operational efficiency are encouraging companies to integrate telematics solutions into their fleet management strategies. These systems enable businesses to monitor vehicle performance, track fuel usage, and gain insights into driver behavior. Fleet managers can schedule maintenance more efficiently with the help of telematics, reducing the likelihood of costly breakdowns and minimizing downtime. Furthermore, telematics offers real-time tracking of vehicles, allowing companies to optimize routes, reduce unnecessary fuel utilization, and improve delivery times. The ability to gather real-time data on vehicle location and driver performance helps businesses ensure safety, reduce accidents, and adhere to regulatory compliance.

- Growing demand for driver safety solutions:

Businesses are becoming more aware about the need to protect their drivers, reduce accident risks, and improve overall safety on the roads. Telematics solutions provide features, including real-time driver behavior monitoring, fatigue detection, and in-cab coaching, all of which contribute to safer driving practices. By tracking speed, harsh braking, and rapid acceleration, fleet managers can identify risky driving habits and take corrective actions. In addition, many telematics systems come with features like collision alerts and lane departure warnings, which further enhance driver safety. Companies are becoming more concerned about road safety and the associated costs of accidents and are turning to telematics as a proactive tool for monitoring and improving driver behavior, reducing the likelihood of accidents, and minimizing liability.

Request PDF Sample for more detailed market insights: https://www.imarcgroup.com/commercial-telematics-market/requestsample

Commercial Telematics Market Report Segmentation:

Breakup By Type:

- Solution

- Fleet Tracking and Monitoring

- Driver Management

- Insurance Telematics

- Safety and Compliance

- V2X Solutions

- Others

- Services

- Professional services

- Managed services

Solution (fleet tracking and monitoring, driver management, insurance telematics, safety and compliance, V2X solutions, and others) exhibits a clear dominance in the market due to the increasing demand for comprehensive telematics systems that integrate data analytics, real-time tracking, and fleet management services.

Breakup By System Type:

- Embedded

- Tethered

- Smartphone Integrated

Embedded represents the largest segment, as it offers enhanced integration, reliability, and security.

Breakup By Provider Type:

- OEM

- Aftermarket

Aftermarket holds the biggest market share owing to the flexible and cost-effective telematics solutions that can be retrofitted into existing vehicles.

Breakup By End Use Industry:

- Transportation and Logistics

- Media and Entertainment

- Government and Utilities

- Travel and Tourism

- Construction

- Healthcare

- Others

Transportation and logistics account for the majority of the market share attributed to the high reliance on telematics for optimizing route planning, improving fuel efficiency, and ensuring timely deliveries.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America dominates the market, driven by the early adoption of telematics technology, well-developed infrastructure, and stringent regulatory requirements for fleet management and safety.

Top Commercial Telematics Market Leaders:

The commercial telematics market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- AirIQ Inc.

- Bridgestone Corporation

- General Motors Company (GM)

- Geotab Inc.

- Michelin Group

- MiX Telematics International (Pty) Ltd

- Octo Telematics S.p.A.

- Omnitracs LLC

- Trimble Inc.

- Bell Atlantic Corporation

- Continental AG

Note: If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145