Varicose veins, those bulging, twisted Are varicose veins covered by insurance? that often appear in the legs, can be more than just a cosmetic issue. They can cause significant discomfort, pain, and even complications if left untreated. For many people, understanding whether their insurance will cover treatment for varicose veins is a critical concern. This article explores the intricacies of insurance coverage for varicose veins, helping you navigate the options and make informed decisions about your treatment.

What Are Varicose Veins and Why Do They Matter?

Understanding Varicose Veins

Varicose veins are veins that become enlarged and twisted, typically appearing on the legs and feet. They occur when the valves inside the veins fail to work properly, causing blood to pool and the vein to stretch. This can lead to symptoms like aching, swelling, and a feeling of heaviness in the legs.

The Impact of Varicose Veins

While some people may experience minimal symptoms, others may face more severe complications, including skin ulcers or blood clots. Beyond physical discomfort, varicose veins can affect a person’s quality of life and self-esteem, making treatment an important consideration for those affected.

Insurance Coverage for Varicose Vein Treatment: What to Know

The Basics of Insurance Coverage

Insurance coverage for varicose vein treatment varies widely depending on your insurance provider, policy, and location. Generally, insurance companies categorize treatments into two main categories: medically necessary and cosmetic.

Medically Necessary Treatments

Insurance is more likely to cover treatments deemed medically necessary. This typically includes treatments aimed at alleviating symptoms or preventing complications. Common medically necessary treatments for varicose veins include:

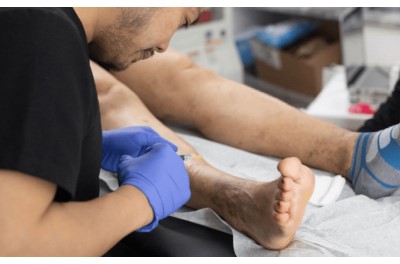

- Sclerotherapy: A procedure where a solution is injected into the vein to cause it to collapse and eventually be absorbed by the body.

- Endovenous Laser Therapy (EVLT): A minimally invasive procedure that uses laser energy to close off varicose veins.

- Radiofrequency Ablation (RFA): Similar to EVLT, this technique uses radiofrequency energy to close the problematic veins.

These treatments are often covered by insurance if they are prescribed by a physician and supported by medical evidence showing that they are necessary for the patient’s health and well-being.

Cosmetic Treatments

On the other hand, treatments that are primarily for cosmetic purposes are less likely to be covered by insurance. These might include procedures aimed solely at improving the appearance of varicose veins without addressing any underlying medical issues. Examples of cosmetic treatments include:

- Vein Stripping: An older surgical technique that removes the veins through small incisions.

- Laser Treatments for Cosmetic Improvement: Non-invasive procedures aimed at reducing the appearance of veins without addressing symptoms.

Steps to Determine Coverage

To determine if your insurance will cover treatment for varicose veins, follow these steps:

- Check Your Policy: Review your insurance policy to understand what types of vein treatments are covered. Look for sections related to vascular conditions or treatments.

- Consult Your Physician: Speak with your healthcare provider about your symptoms and treatment options. Your physician can provide a diagnosis and recommend treatments that may be covered by insurance.

- Preauthorization: Many insurance companies require preauthorization for certain treatments. This means your physician will need to submit a request to your insurance company, providing evidence that the treatment is medically necessary.

- Contact Your Insurance Provider: Call your insurance provider directly to inquire about coverage for the specific treatment recommended by your physician. Be prepared to provide information about your policy and any relevant medical records.

- Appeal Denied Claims: If your insurance claim is denied, you have the right to appeal the decision. Work with your healthcare provider to gather additional documentation and submit a formal appeal to your insurance company.

Financial Assistance and Alternatives

Financial Assistance Programs

If insurance coverage is insufficient or unavailable, consider financial assistance programs. Some healthcare providers and treatment centers offer payment plans or sliding scale fees based on income. Additionally, non-profit organizations may provide grants or financial aid for varicose vein treatments.

Alternative Treatments

For those who face significant financial barriers, exploring alternative treatments or lifestyle changes may help alleviate symptoms. Options include:

- Compression Stockings: Specially designed stockings that help improve blood flow and reduce swelling.

- Lifestyle Modifications: Regular exercise, weight management, and leg elevation can help manage symptoms and prevent worsening of varicose veins.

Conclusion

Navigating insurance coverage for varicose vein treatment can be complex, but understanding your options is crucial for making informed decisions about your health. Medically necessary treatments are more likely to be covered by insurance, while cosmetic procedures typically are not. By checking your policy, consulting with your physician, and contacting your insurance provider, you can determine the best course of action for managing your varicose veins.

If insurance coverage is not an option, exploring financial assistance programs and alternative treatments can provide relief. Remember, taking proactive steps in addressing varicose veins not only improves your quality of life but also helps prevent potential complications.